₹500 SIP to ₹50 Lakh: The Step-Up SIP Strategy Most Beginners Don’t Know 💡

Soch ke dekho — agar main tumse bolu ki step up SIP strategy se bas ₹500/month shuru karke tum future mein ₹50 lakh+ bana sakte ho, toh shayad tum bolo,

‘Bhai, yeh YouTube wale scam type lag raha hai.’ 😅

Par nahi yaar, yeh koi lottery, crypto pump & dump, ya “overnight crorepati” scheme nahi hai.Yeh ek simple, smart investing trick hai — [step up SIP strategy] — jo India ke zyaadatar beginners ko pata hi nahi hoti.

Chahe tum college student ho, fresher job join ki ho, ya soch rahe ho “Main zyada invest tab karunga jab salary badegi” — yeh strategy tumhare liye ek shortcut hai small shuruwaat ko bada banane ka.

Step-Up SIP Strategy Kya Hai? 🧠

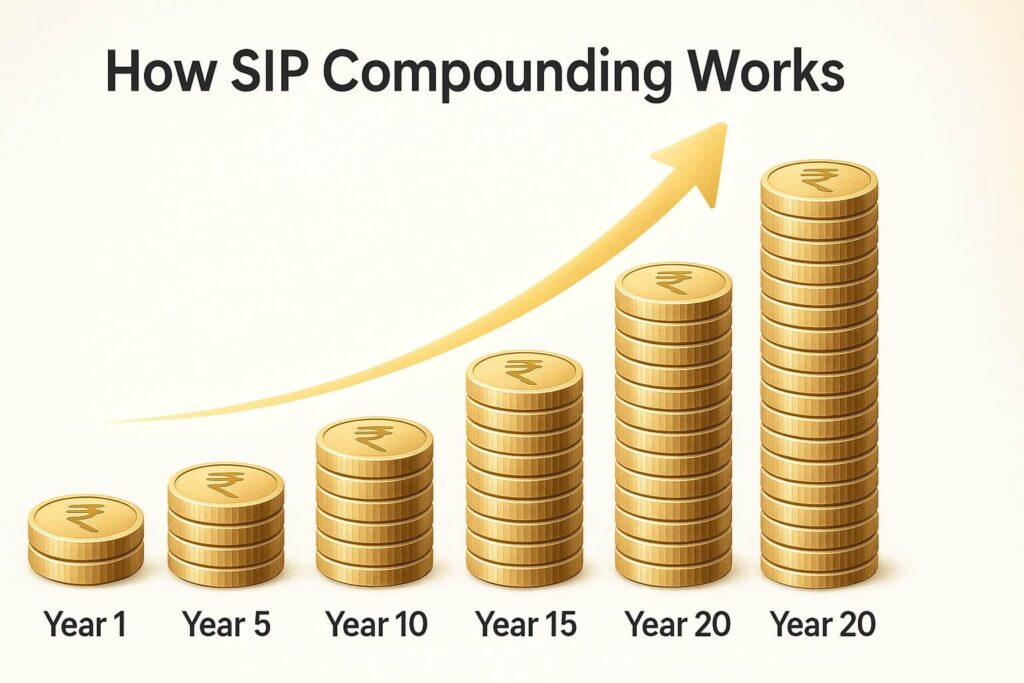

Normal SIP (Systematic Investment Plan) toh sabko pata hai — har month ek fixed amount mutual fund me invest karte ho (Wikipedia – Systematic investment plan) .

Lekin step up SIP strategy me twist yeh hai ki tum har saal apna SIP amount increase karte ho — fixed percentage ya fixed amount se.

Example:

- Year 1: ₹500/month

- Year 2: ₹750/month

- Year 3: ₹1,000/month

- Year 4: ₹1,250/month

… aur aise hi har saal thoda-thoda badhate raho.

Logic simple hai — jaise-jaise tumhari income badhegi, tum thoda zyada invest kar sakte ho bina apni pocket pe zyada load dale. Baaki ka kaam compounding karegi.

(ET ne bhi explain kiya hai how SIP and compounding work together in long-term wealth building) (Economic Times – Explained: The power of compounding through SIPs in mutual funds).

Beginners Kahan Galti Karte Hain? 🤔

Badi common mistake yeh hoti hai ki log small start karke wahi ruk jaate hain.

Haan, ₹500 SIP start karna badiya hai — par agar tum kabhi usko badhaoge hi nahi, toh tum apni earning growth ka fayda miss kar rahe ho.

Inflation har saal tumhare expenses badha raha hai, toh investments ko bhi toh badhna chahiye na?

Step-up SIP ka fayda yeh hai ki tumhare investments inflation se tez grow karte hain, aur goals jaldi achieve hote hain (RBI on Inflation).

₹500 Se ₹50 Lakh Ka Safar 📈 (Real Example)

Chalo ek real scenario dekhte hain:

- Initial SIP: ₹500/month

- Annual Step-Up: ₹500 har saal ka increment

- Expected Return: 12% p.a.

- Duration: 25 years

Year | Monthly SIP | Annual Investment | Wealth After 25 Years |

1 | ₹500 | ₹6,000 | |

5 | ₹2,500 | ₹30,000 | |

10 | ₹5,000 | ₹60,000 | |

25 | ₹12,500 | ₹1,50,000 | ₹50+ Lakh |

Dekha? Yeh magic hai compounding + regular increments ka.

Tum ekdum ₹50 lakh invest nahi kar rahe, bas apne salary ke saath-saath SIP ko step-up kar rahe ho.

Kyun Step-Up SIP India Me Best Kaam Karta Hai 🇮🇳

- Salary Hikes Common Hain – Har saal 5–10% increment milta hai, usme se thoda SIP me daal do.

- Inflation Ko Beat Karta Hai – Fixed SIP inflation se peeche reh sakta hai, step-up SIP aage nikalta hai.

- Bina Sacrifice Ke Discipline – Gradual increase ka pressure nahi lagta.

- Goal-Oriented – Retirement, kids’ education, dream house — sab cover ho sakta hai.

Step-Up SIP Kaise Shuru Karein? 🚀

1️⃣ Right Mutual Fund Choose Karo

Equity mutual fund me invest karo jiska track record strong ho. Beginners ke liye large-cap ya flexi-cap best hain.

Examples: HDFC Flexi Cap Fund, ICICI Prudential Bluechip Fund (Bajaj Broking – SEBI mutual fund regulations) — safe, regulated funds.

2️⃣ Starting Amount Decide Karo

Chahe ₹500 ho ya ₹1,000 — abhi start karo. “Salary badhne ka wait” karte-karte saal nikal jaate hain.

3️⃣ Step-Up Increment Fix Karo

- Fixed % (jaise +10% har saal), ya

- Fixed amount (jaise +₹500 har saal).

4️⃣ Automate Karo

Apps like Groww, Zerodha Coin, Paytm Money me step-up SIP ka option milta hai.

Nahi toh reminder set karo aur har saal manually badhao.

Real-Life Example: ₹500 Se ₹18 Lakh 💰

Mera dost Rohan ne internship me ₹500/month SIP start kiya.

Har saal ₹500 badhata gaya. 10 saal me uska SIP ₹5,500/month ho gaya — bina life me koi major cutback kiye.

Aaj uske investments ka value ₹18+ lakh hai — aur banda sirf 30 ka hai!

Step-Up SIP Strategy Me Avoid Karne Wali Galtiyan ❌

- Zyada Aggressive Increment – Itna mat badhao ki lifestyle disturb ho jaye.

- Market Crash Me Stop Karna – Dips me zyada units milte hain, us time continue karo.

- Fund Performance Ignore Karna – Har saal review karo.

- Beech Me Withdraw Karna – Compounding ka magic time se hota hai.

Mindset Game: Lifestyle Creep Se Bachna

Salary badhne ke baad expenses automatically badh jaate hain — isko lifestyle creep kehte hain.

Step-up SIP isko tackle karta hai — tumhara raise ka ek hissa future investments me chala jaata hai bina tumhe feel hue.

Soch lo, har saal tum apne future self ko ek salary hike de rahe ho.

Final Baatein: Tumhara ₹50 Lakh Plan Aaj Se Shuru 💪

Agar tum 20s ya early 30s me ho, toh tumhare paas sabse badi power hai — time.

Bas ₹500 se start karke aur [step up SIP strategy] follow karke tum easily ₹50 lakh+ bana sakte ho without pressure.

Formula simple hai — Consistency + Small Annual Increments.

Aaj se start karo, automate karo, aur compounding ko apna silent partner bana lo.

💡 Yaad rakho — matter yeh nahi karta ki tum kitne se start karte ho, matter yeh karta hai ki tum kitne baar step-up karte ho.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪