Psychology of Money in India – How Mindset Shapes Your Financial Success 🧠💰

Arre doston, ek baat bolo – paisa sirf numbers, budgets ya investments ka game nahi hai. Paisa ek mindset aur psychology ka game hai. Tum paise ke baare me kaise sochte ho, feel karte ho aur behave karte ho, wohi decide karta hai ki tum financially free banoge ya hamesha month-end broke feel karoge.

Aur India jaisi country me toh scene aur bhi alag hai. Yahan par family ki expectations, shaadi ka pressure, gold-buying tradition aur “log kya kahenge” mindset – sab milke paise ke saath hamari soch ko shape karte hain. Isi liye Psychology of Money in India ek mast interesting topic hai.

Agar tum 18–35 ke age group me ho – college student, fresher, ya apni pehli salary handle kar rahe ho – toh yeh blog tumhare liye gold mine hai. Chalo doston, samajhte hain ki mindset kaise shape karta hai tumhari financial success.

Why Psychology of Money in India Is Different 🌏

India aur West me money psychology ekdum different hai. Yahan paisa sirf personal wealth ka matter nahi hota – balki emotions + culture ka combo hai.

- Family responsibilities: Most of us apni salary ka ek part ghar bhejte hain ya household expenses me contribute karte hain.

- Society expectations: Shaadi, ghar lena, education – yeh sab “mandatory” goals hote hain.

- Cultural beliefs: Gold = investment. Land = asli wealth.

- Peer pressure: Weekend Zomato orders, iPhone upgrades, Goa trips – bas Insta stories ke liye bhi kharcha ho jaata hai.

Isiliye Psychology of Money in India ek unique mix hai – logic + culture + emotion.

Money Mindset Ka Connection 🧩

Tumhari financial habits random nahi hoti. Woh aati hain tumhari money mindset se. Ye mindset banta hai:

1. Childhood Experiences 👶

- Agar ghar me hamesha “paisa kam hai” wali baat hoti thi, toh tum bhi anxious ban jaate ho paise ko lekar.

- Agar parents saving/investing karte the, toh tum discipline seekhte ho.

2. Social Conditioning 📢

- “Beta, sarkari naukri le lo, safe hai.”

- “EMI par ghar lo, warna progress nahi hoga.”

Aisi lines hamare dimaag me chipak jaati hain.

3. Personal Beliefs 💡

- Koi maanta hai “paisa mushkil se milta hai.”

- Koi maanta hai “smart work se paisa aasan se flow karta hai.”

Dono alag belief = dono alag financial life.

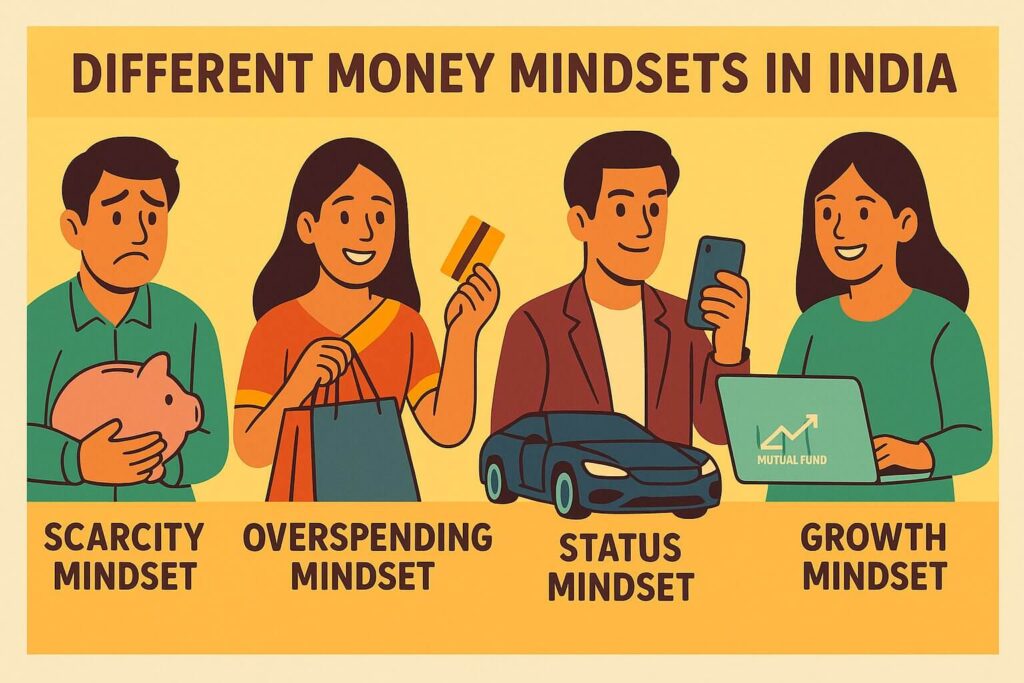

Common Money Mindsets in India (Aur Unka Effect) 🇮🇳

1. Scarcity Mindset 💭

- Belief: “Paise bacha lo, risk mat lena.”

- Effect: Savings account me paisa park karke inflation ke hawale kar dete ho. (RBI inflation data: https://rbi.org.in)

Example: Rohit (26) ke paas ₹5 lakh hai savings me. 10 saal baad inflation uske value ko half kar deta hai.

2. Over-Spending Mindset 🛒

- Belief: “YOLO! Paisa toh aana-jaana hai.”

- Effect: Credit card debt, EMI ka bojh, emergency fund zero.

Example: Priya (24) salary ka zyada hissa Swiggy orders, Zara shopping aur Goa trips pe uda deti hai. Jab medical bill aaya toh loan lena pada.

3. Status Mindset 👑

- Belief: “Log kya kahenge?”

- Effect: iPhone, car, shaadi ke loans – bas dikhawa ke liye.

Example: Ek middle-class family ne shaadi ke liye bada loan liya. 5 saal baad bhi EMI bhar rahe hain.

4. Growth Mindset 📈

- Belief: “Money mere liye kaam kar sakta hai.”

- Effect: SIPs, side hustle, budgeting, financial freedom. (Investopedia SIP guide: https://www.investopedia.com).

Example: Ananya (28) salary ka 20% invest karti hai mutual funds me aur plan kar rahi hai early retirement.

Daily Life Me Psychology of Money in India 🤔

- Café vs. Chai Tapri: Starbucks ₹200 coffee vs. tapri ki ₹20 chai – dono status aur mindset ka game hai.

- Gold vs. Stocks: Parents bolte hain gold safe hai, tum kehte ho equities better hai. Mindset difference.

- EMI Trap: “No-cost EMI” dekh ke khushi me buy karte ho, baad me stress hi stress.

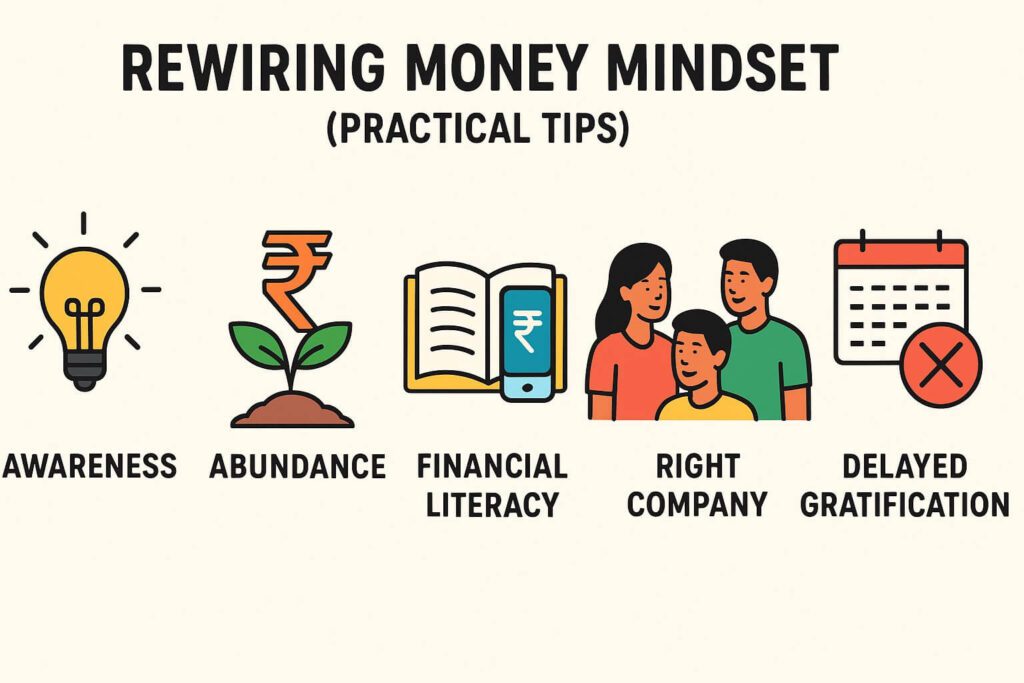

Kaise Rewire Karein Apna Money Mindset 🛠️

1. Awareness Lao 👀

- Pucho khud se: “Kya yeh belief mera hai ya family/social pressure se aaya hai?”

2. Scarcity → Abundance 🌱

- Mat kaho “I can’t afford this.” Kaho “How can I afford this?”

- Sirf expenses cut mat karo, income grow karo.

3. Financial Literacy Seekho 📚

- Books like The Psychology of Money (Morgan Housel).

- Indian finance YouTubers & podcasts – PPFAS, CA Rachana Ranade, etc.

4. Right Company Choose Karo 🤝

- Friends agar sirf party aur shopping ki baat karte hain, tum bhi wahi karoge.

- Agar woh investments aur startups discuss karte hain, tumhara mindset grow karega.

5. Delayed Gratification Practice Karo ⏳

- Latest iPhone EMI pe lene se better hai invest karo, fir cash se buy karo guilt-free.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Desi Money Psychology Hacks 💡

- Cash use karo daily spends ke liye – actual paisa jaate dekhoge toh kharcha control hoga.

- Affirmations bolo – “Main apne paiso ko wisely manage karta hoon.”

- Salary ko buckets me divide karo – bills, savings, fun money.

- Financial goals visualize karo – apna dream home, early retirement picture karo.

- Comparison avoid karo – dost ne car li, iska matlab yeh nahi tumhe bhi abhi leni hai.

Real-Life Indian Stories

- EMI Trap (Arjun, Bangalore): Fresher salary ka half EMI me chala gaya. Result – stress + no savings.

- Investor Mindset (Sneha, Pune): ₹2000 SIP start kiya, 10 saal me ₹30 lakh portfolio.

- Family vs. Individual Belief (Rahul): Parents ne land buy karwaya, Rahul ko index fund lena tha. 10 saal me funds ne land ko beat kar diya.

Emotions Ka Role in Psychology of Money in India ❤️

- Fear: “Invest karna risky hai.” Result = paisa idle.

- Greed: Scam aur quick-rich schemes me phas jaate ho.

- Pride: Dikhawa kharche – “Insta pe show off karna hai.”

- Hope: SIPs aur long-term investing me trust.

Young Indians Ke Liye Money Psychology Kyun Important Hai 🚀

- India = world’s youngest country.

- Jobs insecure ho rahe hain, gig economy badh rahi hai.

- Financial independence = survival + freedom.

- Jo log Psychology of Money in India samajh lete hain, wahi wealth banate hain.

Final Thoughts 💭

Dost, sach bolo toh wealth creation maths ka nahi, mindset ka khel hai. Tum paise ke saath jo feel aur soch rakhte ho, wahi tumhari financial reality banata hai.

Psychology of Money in India humein dikhata hai ki cultural beliefs + family pressure + emotions income se zyada important role play karte hain.

Agar tum growth mindset adopt kar lo, thoda seekh lo aur apni money habits control kar lo – toh chahe salary kitni bhi ho, tum financial freedom achieve kar sakte ho.

👉 Next time jab tum koi money decision lo, puchho:

“Main fear se act kar raha hoon, peer pressure se, ya growth ke liye?”

Bas yaad rakho – tumhari aaj ki soch decide karegi tumhari kal ki financial success. 💰

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪