Personal Finance for Women in India – Building Wealth & Financial Independence 💪💰

Arre doston, ek baat bolo… paisa toh sabke liye important hai na? Lekin honestly bataun toh jab topic hota hai Personal Finance for Women in India, toh conversations aksar side pe chali jaati hain.

Ghar ke budget handle karna? ✅ Women ekdum expert!

Lekin jab baat aati hai investments, wealth creation ya retirement planning ki, toh aksar papa ya husband final decision lete hain.

Ab scene change ho raha hai 👏. Students, working women, homemakers ya entrepreneurs – sabko samajh aa raha hai ki financial independence = real freedom. Sirf paisa kamaana hi kaafi nahi hai, balki usko sahi tareeke se save, invest aur grow karna hi asli game-changer hai.

Aaj ke blog me, main tumhe step by step dikhaugi ki Personal Finance for Women in India ko kaise master karna hai – budgeting se lekar investments tak, taaki tum apne money ka control confidently le sako. 🚀

Why Personal Finance is Extra Important for Women in India 🌸

Dekho yaar, yeh sirf “luxury” ka matter nahi hai. Women ke liye paisa = security + freedom.

- Life Expectancy Advantage: Indian women generally men se zyada jeeti hain, matlab zyada saal apne aapko financially support karna padega (World Bank Data) .

- Career Breaks: Shaadi, maternity ya family ki wajah se career breaks common hain. Savings aur planning se tum stress-free reh sakti ho.

- Freedom of Choice: Solo trip pe jaana hai? Higher studies karni hai? Apna startup kholna hai? Paisa tumhe choices deta hai.

- Emergency Cushion: Health issue, job loss ya personal emergency – apna paisa hone ka matlab hamesha independent rehna.

💡 Example: Priya (28, Bangalore me software engineer) ne maternity break liya but zero savings thi → struggle hi struggle. Lekin uski colleague Aarti ne mutual funds aur emergency fund ready rakha tha → mast stress-free break enjoy kiya.

Lesson: Money management = power. 💥

Step 1: Budgeting Basics – 50-30-20 Rule 📝

Investments se pehle apna budget pakka karo.

Simple sa rule follow karo – 50-30-20:

- 50% Needs → Rent, groceries, EMIs, Jio recharge, bills

- 30% Wants → Swiggy orders, café outings, shopping

- 20% Savings/Investments → SIPs, FD, gold, insurance

👉 Pro Tip: Use apps like Walnut, MoneyView, ET Money – tumhare expenses ka ekdum clear picture milta hai.

💡 Relatable Example: Riya (DU student) ne apna Swiggy spend track kiya. Shock! ₹4,000/month sirf food delivery pe ja raha tha. Ab ghar ka khana 3 din aur wohi paisa SIP me invest → future secure, health bhi secure.

Step 2: Emergency Fund – Apni Safety Net 🚨

Life unpredictable hai boss! Job chali jaaye, health issue ho, ya koi urgent kharcha aa jaaye – tab tumhara emergency fund kaam aayega.

- At least 6 months ka kharcha side me rakho.

- Isko liquid fund ya high-interest savings account me rakho.

- Kabhi bhi shopping ke liye mat use karna 😅 – sirf real emergencies ke liye.

💡 Example: Shalini (Mumbai marketer) ko COVID ke time layoffs face karni padi. Lekin uske paas ₹2.5 lakh emergency fund tha → bina loan liye 7 months smoothly nikal gaye.

Step 3: Smart Savings Habits 💡

Savings = planning, not leftovers.

Kuch simple hacks:

- Salary aate hi auto-SIP/ECS set kar lo.

- Lifestyle inflation mat lao (salary badhi toh shopping bhi double kyu bhai?).

- Credit card EMIs aur BNPL traps avoid karo.

💡 Example: Sneha (25, teacher) ne EMI-based iPhone lene se mana kiya. Instead, ₹2,000/month save kiya aur 10 months baad cash me phone liya. Zero debt, full satisfaction.

Step 4: Insurance – Sabse Pehle Protection 🛡️

Zyada women sochti hain ki “husband ya papa ka insurance kaafi hai.” Big mistake!

Tumhe apna insurance chahiye:

- Health Insurance: Company ka plan alag hai, apna personal cover bhi rakho.

- Term Insurance: Agar tum earning ho aur family tum par depend hai → must-have.

- Critical Illness Cover: Especially important for women (cancer, PCOS-related health issues rising).

👉 Insurance = expense nahi, lifesaver.

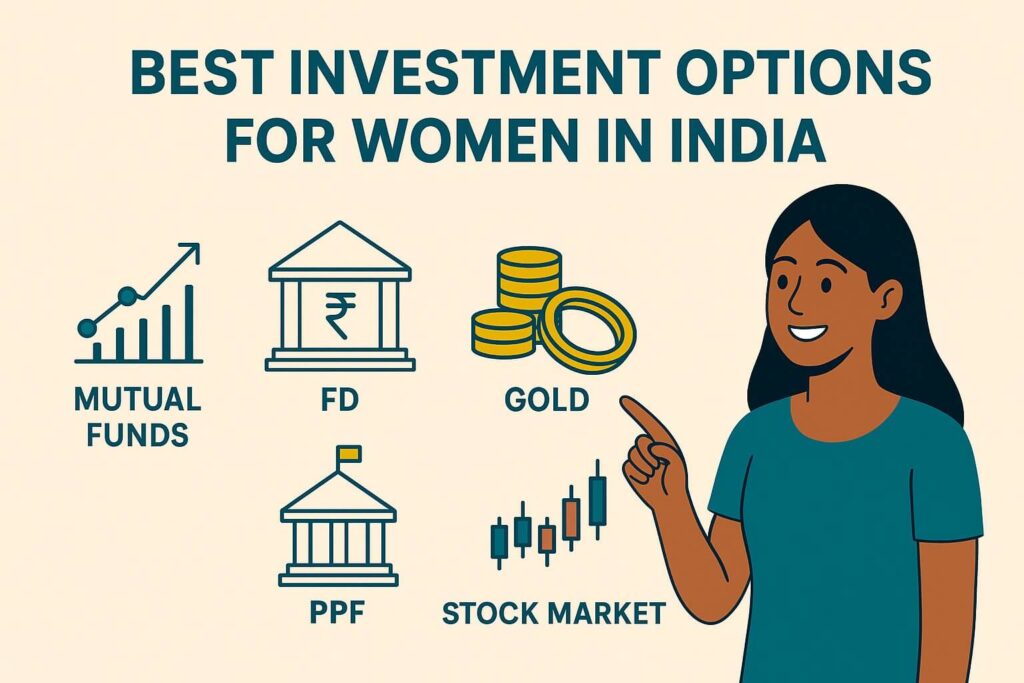

Step 5: Best Investment Options for Women in India 📈

Sirf savings se paisa grow nahi hoga. Invest karna zaroori hai.

Mutual Funds (SIP)

- ₹500/month se start karo.

- Equity MFs → long-term wealth.

- Debt MFs → safe returns.

Fixed Deposits (FD)

- Risk-free option.

- Senior women ko extra interest milta hai.

Gold Investments

- Gold ETFs, Sovereign Gold Bonds > physical gold.

- Indian women ka emotional connect bhi aur inflation hedge bhi.

Public Provident Fund (PPF)

- Govt-backed safe option.

- 15 saal lock-in, retirement ke liye mast.

Stock Market (Direct Equity)

- Thoda seekh kar hi start karo. Blue-chip stocks safe option.

💡 Example: Aditi (30, banker) ne ₹5,000/month SIP start kiya 23 ki age se. Ab 7 saal me uska ₹7+ lakh ka corpus ban gaya. Compounding = magic! ✨

Step 6: Retirement Planning 👵

Shaadi ke baad husband ki pension/savings par depend rehna = risky. Tumhe apna plan chahiye.

- PPF, NPS ya retirement mutual funds me jaldi start karo.

- Sirf ₹3,000/month at 25 → crores by 60.

- Women usually zyada jeeti hain → aur bhi zaroori hai.

💡 Example: Sunita aunty sirf husband ki pension pe dependent thi, ab struggle kar rahi hain. Anita aunty ne apna PPF + MFs rakha → ab chill retirement enjoy kar rahi hain.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Step 7: Side Hustles = Extra Paisa 💻

Sirf salary pe mat depend raho. Aaj kal multiple income streams = survival hack.

Ideas for women:

- Freelancing (content writing, tutoring, Insta management)

- Meesho/Amazon pe apna small business

- YouTube/Instagram (finance, food, fashion, fitness)

- Skill workshops & digital courses

💡 Example: Kavya (Pune student) ne baking hustle start kiya. ₹15,000/month extra earn karti hai, jo seedha mutual funds me jaata hai.

Step 8: Break the Social Barriers 🚀

Society kabhi-kabhi bolegi:

- “Investments? Husband manage karega.”

- “Retirement? Tumhe tension kyu?”

Arre bhai, paisa ka gender nahi hota! 👊

👉 Join communities jaise Women on Wealth, LXME, HerMoneyTalks – safe space jahan women openly finance discuss karti hain.

Step 9: Money Mindset for Women 🧠

Money management numbers ka game nahi, mindset ka game hai.

- Chhoti shuruat bhi badi ban sakti hai → consistency important.

- Mistakes se daro mat, sab seekhte hain.

- Long-term goals pe focus karo, quick profit ke chakkar me mat padho.

💡 Example: Nidhi pehle stock market se darti thi. SIP ₹1,000/month start kiya, ab khud apna portfolio handle karti hai. Confidence level = 🔥.

Step 10: Tools & Apps for Easy Finance 📱

Apni life easy banane ke liye yeh apps try karo:

- ET Money, Groww, Zerodha → Investments.

- Walnut, MoneyView → Expense tracking.

- LXME → India ka women-focused finance platform.

- Books → Let’s Talk Money (Monika Halan), Psychology of Money.

Final Thoughts – Personal Finance for Women in India 🌟

Dekho girls, end of the day paisa = freedom + choices. Aur agar tum apna paisa khud handle karna seekh gayi, toh tumhe koi rok nahi sakta.

Recap kar lete hain:

- Budget smartly

- Save regularly

- Invest consistently

- Insurance zaroor lo

- Retirement ke liye early planning karo

💡 Personal Finance for Women in India sirf competition ka matter nahi hai, yeh tumhari security, independence aur dignity ka matter hai.

So ladies, kal se nahi… aaj se start karo. Best investment tum apni financial independence me kar sakti ho. 💖

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪