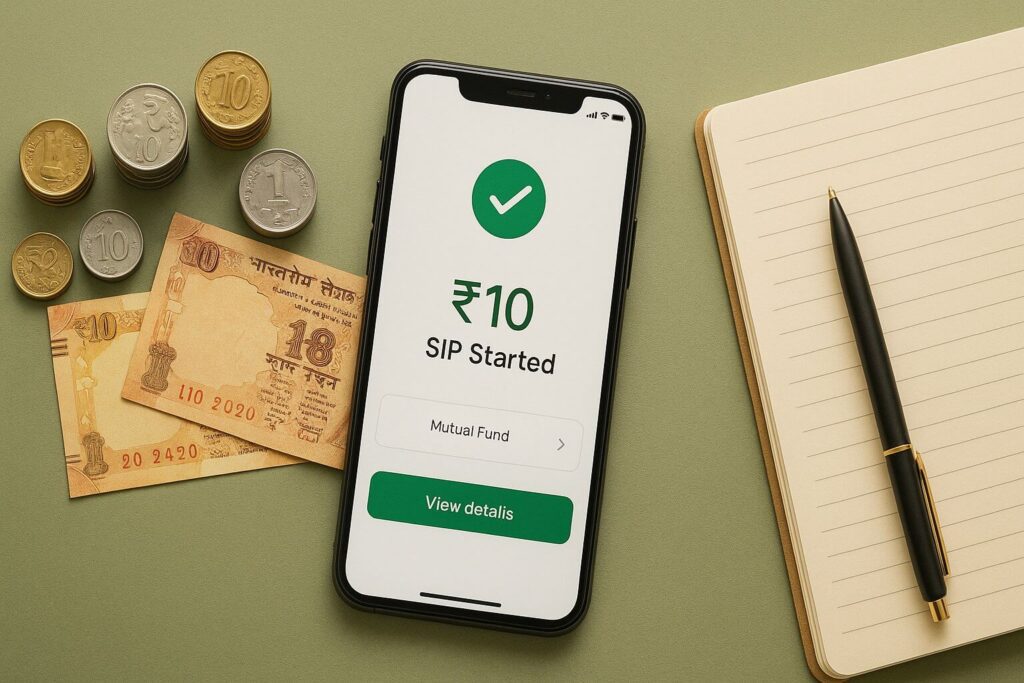

Micro-Investing in India: ₹10 Daily Se Start Karo Apna Mutual Fund Journey 🚀

Socho, jab tum “investing” ka naam sunte ho, toh dimaag mein kya aata hai?

Ek suit-pehene hue uncle jo business newspaper padh rahe hain, aur lakhon rupaye stock market mein daal rahe hain?

Same yaar! Mujhe bhi lagta tha ki investing sirf bade logon ka kaam hai… jab tak maine micro investing India ke baare mein nahi suna tha.

Ab socho, agar main tumse kahu ki tum sirf ₹10 per day se apna mutual fund journey start kar sakte ho? Haan, ek chai ya 2 Parle-G packets ke price mein! Na koi badi salary chahiye, na MBA degree, na hi koi heavy finance ka gyaan.

Aaj is blog mein main tumhe bataunga:

- Micro-investing hota kya hai

- Kaise kaam karta hai India mein

- Aur kyu yeh students & first-time investors ke liye perfect low-entry option hai.

Micro-Investing in India Kya Hai? 🤔

Micro-investing ka simple matlab hai — chhoti-chhoti amounts invest karna regularly. Kabhi ₹10/day, kabhi ₹100/month. Matlab lump sum ke tension nahi, bas thoda-thoda invest karte jao.

India mein yeh mostly SIP (Systematic Investment Plan) ke through hota hai. Tum ek fixed amount set kar dete ho jo bank se auto-debit hota hai, aur mutual fund units buy ho jaati hain — monthly ya daily basis pe (app pe depend karta hai).

💡 Example:

Har shaam ₹20 ka chips khane ka habit hai? Usme se ₹10 bacha ke daily invest karo mutual fund mein. Ho gaya ₹300/month. 5 saal mein, normal returns ke saath yeh savings account se kaafi zyada grow karega.

₹10 Daily Kyu Game-Changer Hai 💡

Investing ke case mein hum sab excuses dete rehte hain:

- “Pehle salary badhe tab shuru karunga.”

- “Kam se kam ₹5,000 chahiye start karne ke liye.”

- “Mutual funds risky hote hain, baad mein dekhte hain.”

Par sach yeh hai — jitna jaldi start karoge, utna zyada paisa grow karega compounding ki wajah se. Aur ₹10/day start karke excuses ka chance khatam.

📊 Quick Math:

- ₹10/day = ₹300/month

- Agar 12% annual return ke mutual fund mein invest karo, 20 saal baad sirf ₹72,000 invest karke tumhare paas hoga lagbhag ₹2.98 lakh!

Aur tumhe mehsoos bhi nahi hoga ki tum invest kar rahe ho.

Micro-Investing in India Kaise Shuru Karein

Chalo ek step-by-step beginner’s guide dekhte hain jo ek broke college student bhi follow kar sakta hai:

1️⃣ Right App Choose Karo 📱

India mein kaafi apps hain jo ₹10/day ya ₹100/month se SIP allow karte hain:

- Groww – min ₹100/month

- Paytm Money – daily SIP ₹10–₹20 se start

- Kuvera – ₹100/month min

- ET Money – ₹100/month min

💡 Pro Tip: “Direct Mutual Funds” choose karo — inka expense ratio kam hota hai.

2️⃣ Beginner-Friendly Fund Choose Karo

First time investor ho? Toh yeh low-risk options dekh lo:

- Liquid Funds → Short-term money park karne ke liye, almost no risk

- Index Funds → Nifty 50/Sensex follow karte hain, beginners ke liye best

- Balanced Funds → Equity + Debt ka mix, moderate risk

Agar tum different fund types ko compare karna chahte ho, toh Investopedia ka guide dekh sakte ho — clear aur beginner-friendly hai.

3️⃣ Auto-Debit Lagao

Micro-investing ka magic tabhi kaam karega jab tum automatic kar doge.

Example: ₹300/month ka auto-debit lagao, app khud har month fund units le lega.

4️⃣ Bhool Jaao Aur Compounding Ko Kaam Karne Do

Jitna lamba paisa laga rahe ho, utna zyada magic hoga. Be patient, withdraw mat karo.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Real-Life Desi Examples 📍

- College Student – Riya: Daily ₹50 cold coffee pe udati thi. Ab 2 din skip karke ₹20/day invest karti hai index fund mein. 3 saal mein ₹27,000 bana liya — ek solo trip funded!

- First Jobber – Amit: ₹18k/month salary, ₹10/day SIP se start kiya. 1 saal baad growth dekh ke ₹1,000/month SIP kar di.

- Freelancer – Priya: Irregular income, toh Paytm Money ka “Invest Spare Change” feature use karti hai. Recharge ₹92 hua toh ₹8 bacha ke invest ho jata hai.

Benefits of Micro-Investing in India

✅ Low Entry Barrier

Sirf ₹10/day se start. Perfect for students, interns, freshers.

✅ Financial Discipline

Chhota amount invest karke habit develop hoti hai. Phir amount badhana easy ho jata hai.

✅ Low Risk Learning

Market girta bhi hai toh loss negligible hota hai. Fear kam ho jata hai.

✅ Compounding Power

Small + consistent investment = future mein bada amount.

Myths Busted 🛑

❌ Myth 1: ₹10/day se kuch nahi hota.

✔ Truth: Habit ban rahi hai + compounding ka magic long-term mein kaam karta hai.

❌ Myth 2: Mutual funds risky hote hain.

✔ Truth: Risk depend karta hai fund type pe. Liquid ya balanced fund se start karo.

❌ Myth 3: Advisor ke bina start nahi kar sakte.

✔ Truth: Apps + UPI ke saath start karna food order karne jitna easy hai.

Pro Tips for Micro-Investing

- SIP amount gradually badhao (₹10/day → ₹20/day → ₹50/day)

- Dividends ko reinvest karo

- Monthly check karo, daily nahi

- Withdraw mat karo — patience is profit

Final Baat 💬

Micro investing India ka matlab overnight crorepati banna nahi hai — iska matlab hai jaldi shuru karna, chhota shuru karna, aur habit banana.

Chahe tum Delhi ke student ho, Bangalore ke fresher ya Pune ke freelancer — ₹10/day ke liye excuse nahi ban sakta.

Aaj ka ₹10 future ka financial freedom ban sakta hai. Toh app kholo, ₹10 ka SIP lagao aur apni mutual fund journey shuru karo.

Agar tum investment ke regulations aur safety ke baare mein detail mein jaana chahte ho, toh RBI ka investor awareness portal bhi check kar sakte ho — trusted aur up-to-date information milegi.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪