Best Investment Plan for Child’s Future in India – Apne Bacche Ke Sapne Secure Karo 🎓💰

Socho yaar – aaj tumhara chhota baccha ghar mein chocolate aur toys ke liye rona-dhona kar raha hai. Aur dekhte hi dekhte 15 saal baad woh bolega, “Papa/Mummy, mujhe IIT ka admission mil gaya, fees ready hai na?”

Aur tum sochoge – kaash tab maine ek smart investment plan for child future shuru kiya hota, aaj yeh kharcha Swiggy ke monthly bill ki yaad dila raha hai! 😅

Sach bolo, aaj ke inflation ke hisaab se future ke education aur dreams ka kharcha kaafi bada hone wala hai. Isi liye best investment plan for child future choose sirf ek smart move nahi, ek zaroorat hai.

Yeh sirf paisa save karne ka game nahi hai — yeh paisa smartly grow karne ka plan hai, taaki tumhare bacche ke sapne paiso ke chakkar mein adhoore na reh jaayein.

Early Investment Plan for Child Future Kyun Game-Changer Hai 🚀

Agar tum apni 20s ya early 30s mein ho, toh tumhare paas ek superpower hai — time. Jitni jaldi invest karoge, utna zyada tumhare paiso ko compounding ka magic milega.

Example dekh lo:

- Tum bacche ke birth se hi ₹5,000/month ek accha mutual fund SIP mein lagana shuru karte ho.

- Average 12% return maan lo, toh jab baccha 18 ka hoga, tumhare paas ₹28–30 lakh ready honge.

- Agar 10 saal baad shuru karte, toh half se bhi kam amount banta.

Early start = kam tension + bada fund.

Agar tum investment ke basics aur compounding ke effect ko aur achhi tarah samajhna chahte ho, toh Investopedia ka yeh guide check kar sakte ho.

Investment Plan Choose Karne Se Pehle Kya Sochna Chahiye 🧐

- Time horizon – Kitne saal baad paisa chahiye?

- Goal type – Education, marriage ya business start-up?

- Risk appetite – Market ke uthal-puval ko jhel paoge ya fixed return chahiye?

- Liquidity – Beech mein paisa nikalne ki zarurat padegi?

- Tax benefits – Section 80C, 10(10D) ka fayda mil raha hai ya nahi?

Agar tax benefits ke baare mein detail mein padhna ho toh Income Tax Department ki official website dekho.

1. Mutual Funds – Equity SIPs for Long-Term Growth 📈

Agar tumko high growth chahiye aur short-term market ka drama jhel sakte ho, toh Equity Mutual Funds best option hai.

Kyu bacche ke future ke liye perfect hai:

- 10–14% annual long-term returns ka track record.

- ₹500/month se shuru kar sakte ho.

- Flexible – SIP badhao, kam karo, pause karo jab chaaho.

Example:

₹10,000/month ka SIP, bacche ke age 1 se shuru karke 12% return pe — 18 saal mein ~₹60 lakh ka fund ready.

Pro tip:

Index fund ya top-rated flexi-cap fund le lo. Aur 10–15 saal tak hold karo.

2. Sukanya Samriddhi Yojana (SSY) – Beti Ke Sapno Ka Safety Net 🎀

Agar beti hai, toh yeh plan must-have hai.

Highlights:

- Government-backed safe plan.

- Interest rate ~8.2% p.a. (quarterly update hota hai).

- ₹1.5 lakh/year tak invest kar sakte ho 15 saal ke liye.

Kya fayda hai:

Education + marriage ke liye guaranteed returns + triple tax benefits.

Example:

₹5,000/month birth se age 15 tak invest → maturity pe ₹40–45 lakh.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

3. Public Provident Fund (PPF) – Safety First 📜

PPF ek low-risk, long-term plan hai jo boy ya girl, dono ke liye fit hai.

Why choose PPF:

- Govt. of India guarantee.

- ~7.1% p.a. interest.

- Tax benefit under Section 80C.

Equity se kam return milega, lekin safety pakki hai.

Agar PPF account kholne ya rules ke baare mein aur jaana ho toh RBI ya India Post ki website par details milengi.

4. Child Insurance Plans – Protection + Savings 🛡️

Ye plans basically life insurance + investment ka combo hote hain.

Kaise kaam karta hai:

- Parent premium deta hai.

- Agar parent ko kuch ho jaye toh premium maaf, maturity pe paisa fir bhi milega.

Example:

HDFC Life YoungStar Udaan, ICICI Pru SmartKid kaafi popular hai.

Tip: Kabhi-kabhi mutual fund + term insurance combo zyada smart hota hai.

5. NSC & Fixed Deposits – Stability Lovers Ke Liye 🔒

Agar tumko market ka risk bilkul pasand nahi, toh NSC ya long-term FD ek safe option hai.

Pros:

- Fixed return.

- Short/medium-term goals ke liye perfect.

Cons:

- 6–7% return, jo inflation ko beat nahi karega.

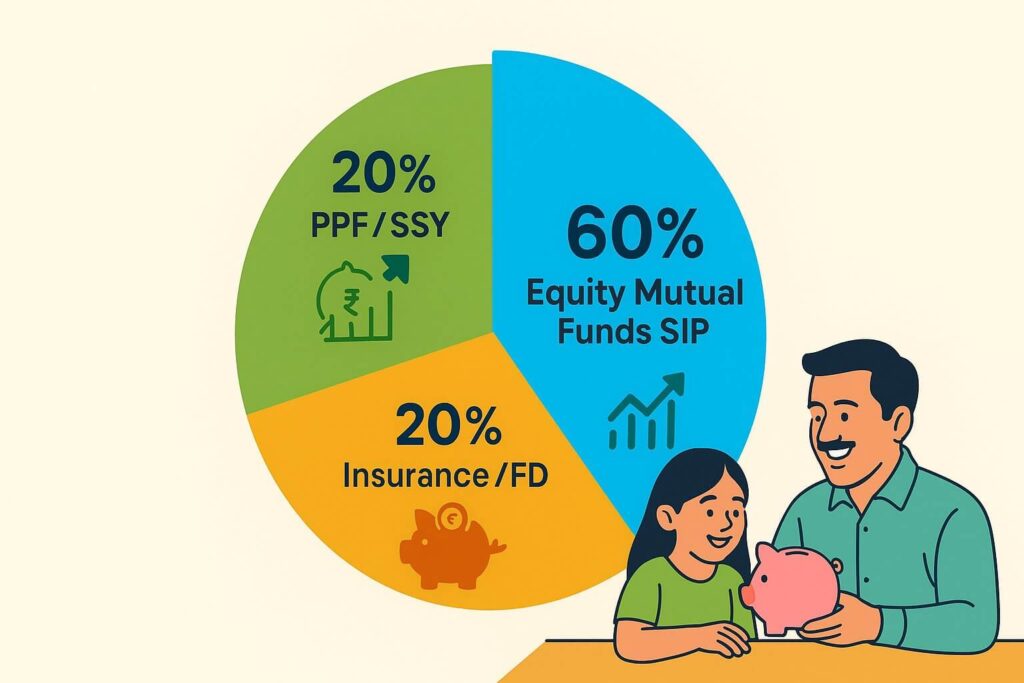

Smart Portfolio Mix for Child’s Future 🎯

Ek balanced plan ho sakta hai:

- 60% Equity Mutual Funds SIP

- 20% PPF / Sukanya Samriddhi

- 20% Child Insurance / FD

Yeh mix growth + safety dono deta hai.

Real-Life Story 📌

Ravi & Neha, Pune:

- Bacche ke age 2 se ₹8,000/month mutual fund mein SIP.

- Saath mein ₹3,000/month PPF.

- 15 saal mein ₹40 lakh mutual fund + ₹10–12 lakh PPF ka target.

College fees ke liye zero loan tension.

Investment Plan for Child Future Ko Strong Banane Ke Tips 💡

- Early start karo – amount chhota ho toh bhi chalega.

- Salary hike ke saath SIP badhao.

- Fund ko other needs ke liye touch mat karo.

- Har 1–2 saal mein review & rebalance karo.

- Inflation ka dhyaan rakho – education cost har 8–10 saal mein double hota hai.

Final Thoughts – Abhi Start Karo, Future Secure Karo 🌟

Best investment plan for child’s future choose karna ka matlab hai ek consistent investing habit banana.

Chahe bacche ka IIT/IIM ka sapna ho ya start-up ka plan, sahi investment se tum unke liye ek strong financial cushion bana sakte ho.

Bada paisa nahi, bada time important hai — isliye jitni jaldi shuru karoge, utna badiya future banao ge.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪