How I Saved ₹50,000 in 90 Days – Netflix, Swiggy, Zomato Sab Chalu Tha!

Socho zara — Netflix bhi chalu tha, Swiggy se biryani bhi aa rahi thi, weekend Zomato bhi active tha… fir bhi maine sirf 3 months mein ₹50,000 save kar liye! 😮

Agar tum bhi soch rahe ho how to save money fast bina apna chill lifestyle chhode, toh bro/sis — you’re not alone.

Main bhi pehle sochta tha ki paisa bachane ka matlab hota hai:

“Na bahar khana, na subscriptions, na maza…” 😑

Lekin real talk — saving is more about smart money habits + thoda desi jugaad, not sacrifice. Iss blog mein, main apna pura 90-day experience share karunga — full honest, real-life tips ke saath.

🤔 Kyun Normal Budget Tips India Mein Kaam Nahi Karte (Especially for 20s Wale Log)

Har jagah sunne ko milta hai:

- “Bahar khana band karo”

- “Netflix cancel kar do”

- “Coffee pe paisa waste mat karo”

But bhai, agar tum ek normal Indian ho jo office/college se thak ke aata hai, thoda chill toh banta hai na?

Aur Hotstar pe India vs Pakistan dekhna, ya Zomato pe weekend treat lena — yeh sab chhodne se toh life hi boring ho jati hai.

So, maine decide kiya — balance banate hain, na ki torture.

🔍 Step 1: Har Ek Paisa Track Kiya (No Spreadsheets, Promise!)

Sabse pehle maine ek simple habit banayi — daily 5 min ke liye paisa track karna.

Main koi Excel expert nahi hoon, so I used the Walnut app (free + Indian friendly).

Chahe UPI ho ya Paytm, ya cash — sab record karna shuru kiya.

📊 Pehli Week ka Shocking Result:

- ₹2,500/month Amazon ke “deal of the day” mein ud ja rahe the 😶

- Kuch ₹199 wale useless app subscriptions active the

- Swiggy pe food se zyada charges lag rahe the 😩

💡 Lesson: Jab tak pata nahi chalega paisa kidhar jaa raha hai, tab tak bachaoge kaise?

💸 Step 2: Banaya Apna “Chiller Budget” (Jo Follow Kar Paun)

Main koi strict budget wala insaan nahi hoon.

Toh maine banaya ek Chiller Budget — realistic, flexible & jisme Netflix allowed ho 😎

🧾 Category | 💰 Monthly Limit |

Rent + Bills | ₹15,000 |

Groceries + Essentials | ₹4,000 |

Eating Out (Yes, allowed) | ₹2,500 |

OTT + Fun + Shopping | ₹1,500 |

Pure Savings | ₹5,000+ |

Trick kya tha?

Mainne Netflix, Zomato, aur thoda chill spending already budget mein daal diya.

Isiliye guilt-free enjoy bhi kiya aur save bhi.

🧠 Step 3: Desi Frugal Jugaads Master Kar Liye

Comfort sacrifice nahi kiya, bas smart tarike dhoondhe.

Yeh rahe mere top hacks:

🍕 Swiggy/Zomato Hacks:

- Zomato Gold ke “Buy 1 Get 1” offer ka full use

- Local tiffin service (₹89 ka meal!) instead of ₹250 restaurant

- Off-peak timing mein order kiya = delivery sasti

📺 Netflix & OTT Sharing:

- Cousins ke saath Netflix, Prime, Disney+ share kiya (per head ₹100-200)

- Tata Play Binge combo liya (₹249/month for all OTT)

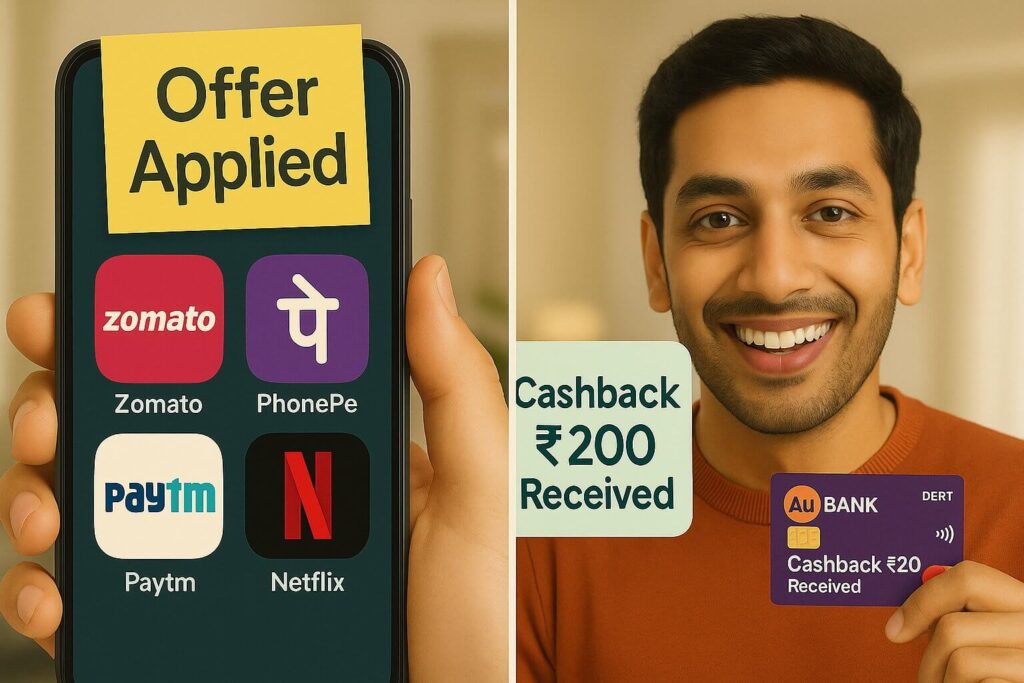

💳 Cashback Jugaad:

- AU Bank & SBI debit cards liye jo food/OTT pe cashback dete hain

- PhonePe & Paytm UPI se payment kiya during cashback offer (₹25-₹50 bhi badi baat hai)

💡 Baat yeh hai: Paisa bachana = comfort chhodna nahi, system ko hack karna hai!

🛠️ Step 4: Weekend Side Hustle Se Extra ₹4,000/Month Kama Liya

Yeh meri savings journey ka real hero tha.

Mainne weekend side hustle pick kiya jisme koi experience nahi chahiye tha.

💼 Mera Side Hustle Setup:

- Insta captions likhe (₹300 per post – 30 min ka kaam)

- Fiverr pe apps review kiye (₹500/review)

- OLX pe old gadgets bech diye (Mi Band, earphones, etc.)

Average ₹4,000/month kamaaya — jo directly savings mein gaya.

No touch, no spend. 💯

🔑 Pro Tip: Chahe ₹1,000 ho, side income = fast savings boost.

🏦 Step 5: Auto-Saving Ka Magic (Set & Forget Style)

Maine ek naya digital savings account khola (IDFC First recommended 👌)

Aur har mahine ki 1st date ko ₹5,000 auto-transfer set kar diya.

- Iss account ka no UPI, no debit card, no net banking

- Bas “no access = no temptation” policy!

3 months ke end tak — side hustle + auto savings mila ke total ₹50,000! 🎉

✅ How to Save Money Fast in India – Real Takeaways

Agar tum bhi soch rahe ho how to save money fast bina life ko boring banaye, toh note karo yeh asli kaam ke tips:

✔️ Spend with Soch

Shopping se pehle bas yeh socho: “Zarurat hai ya boredom hai?”

✔️ Plan Your Chill Spending

Biryani order karo, but har dusre din nahi 😅

✔️ Cashback Loyalty Banao

Jab kharch kar rahe ho, ₹50 bhi wapas mile toh bura nahi hai

✔️ Side Hustle Try Karo

Even ₹1,000/weekend bhi ek proper saving game ban sakti hai

✔️ Automate Your Savings

Jo aankhon se door, vo kharche se bhi door.

🧾 Final Thought: Netflix Ko Off Karne Ki Zarurat Nahi Hai Bhai

Saving = boring hona nahi.

Agar main metro city mein rehke, full-time job ke saath ₹50K save kar sakta hoon bina Netflix, Swiggy, aur Zomato chhode — toh tum bhi kar sakte ho.

Bas shuru karo with tracking, budgeting, thoda hustle, aur smart choices.

So next time jab koi puche how to save money fast, just share this blog & bolo —

“Netflix bhi chalu hai aur savings bhi!” 💸🔥

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪