How to Improve CIBIL Score in India – Desi Style Proven Steps for Faster Credit Growth 💳

Soch ke dekho – tum Swiggy, Zomato, Amazon, Flipkart pe shopping karte ho, ya kabhi-kabhi travel ke liye credit card swipe karte ho. Ab jab tumhe ek personal loan, home loan ya car loan chahiye hoga… bank ka pehla sawaal hoga – “CIBIL score kitna hai?” 😅

Aur honestly yaar, yeh score ek secret passcode ki tarah hai jo tumhe better interest rates, high credit limit aur fast loan approvals dilata hai. Lekin agar yeh low ho gaya, toh ₹50,000 ka chhota personal loan bhi reject ho sakta hai.

Is blog mein main tumhe [How to Improve CIBIL Score in India] ke pure proven steps bataunga jo tum aaj se follow karoge toh 6–12 mahine mein fark dikhne lagega.

CIBIL Score Kya Hota Hai Aur Kyon Important Hai?

CIBIL score ek 3-digit number (300 se 900) hota hai jo batata hai tum bank ke liye kitne trustworthy borrower ho.

- 750+ → Excellent (Banks tumhe pyaar karenge ❤️)

- 650–749 → Good (Approval chances high)

- 550–649 → Average (Interest zyada, terms tough)

- <550 → Poor (Loan milna mushkil)

Socho jaise school ka report card hota hai — low marks = extra homework. Waise hi low CIBIL = bank ka extra chakkar.

CIBIL Score Kaise Calculate Hota Hai?

Tumhara score kuch random number nahi hota. Yeh based hai:

- Payment History (35%) – EMI aur credit card bills time pe diye ya nahi

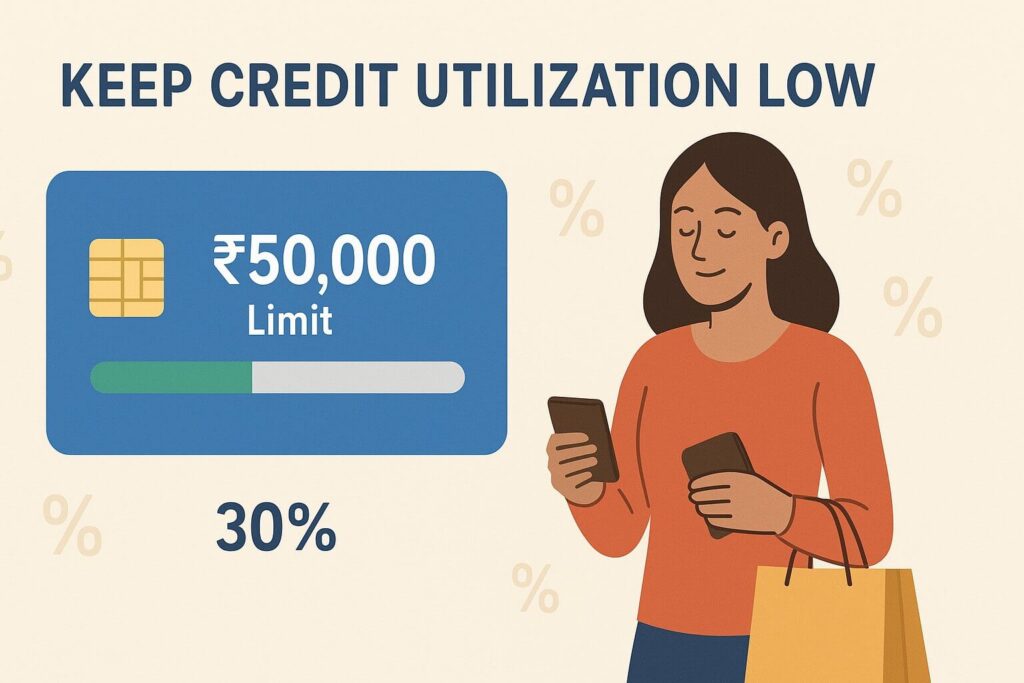

- Credit Utilization (30%) – Credit limit ka kitna use kar rahe ho

- Credit Mix & Duration (25%) – Loan ka type aur kitne time se credit use ho raha hai

- Credit Enquiries (10%) – Kitni baar credit apply kiya

💡 Example:

Agar tumhari credit limit ₹1,00,000 hai aur tum har month ₹90,000 use karte ho, toh utilization high hai → score hurt karega, chahe tum time pe pay karo.

Aur detail samajhne ke liye dekh lo: Investopedia – What Is a Credit Score?

[How to Improve CIBIL Score in India] – 10 Desi Proven Steps

Chalo ab asli kaam ki baat. Ye steps India me practically kaam karte hain.

1. Hamesha Bills Time Pe Pay Karo ⏰

📌 Kyon: Payment history sabse zyada impact karti hai. Ek bhi late EMI score ko months tak damage kar sakta hai.

Kaise karein:

- Bank app se auto-pay set karo

- Google Pay / PhonePe pe UPI reminders lagao

- Last day pe nahi, 2–3 din pehle pay karo

💬 Example:

Rohan (Mumbai) ne ek ₹800 ka credit card bill miss kar diya trip ke chakkar me. Score 760 se 720 ho gaya, recover karne me 6 mahine lag gaye.

2. Credit Utilization 30% Se Kam Rakho 📉

📌 Kyon: Bank ko lagta hai tum credit responsibly use kar rahe ho. Limit ka full use = red flag.

Tips:

- ₹50,000 limit me ₹15k–₹20k se zyada spend mat karo

- Credit limit badhane ka request karo agar zarurat ho

- Multiple cards me expenses divide karo

3. Credit Mix Healthy Rakho 🏦

📌 Kyon: Secured loans (home/car) + unsecured loans (personal/credit card) ka mix score ko improve karta hai.

Tips:

- Sirf cards ho toh ek chhota personal loan leke time pe repay karo

- Sirf score improve karne ke liye loan mat lo – zarurat ho tabhi

4. Short Time Me Multiple Loans Mat Apply Karo 🚫

📌 Kyon: Har application ek “hard enquiry” hoti hai. Zyada enquiries = desperate borrower vibes.

Tips:

- Applications 6 mahine ka gap deke karo

- Apply se pehle online eligibility check karo

- Bank ke pre-approved offers ka use karo

5. Apna CIBIL Report Check Karo – Galti Ho Sakti Hai 🕵️♂️

📌 Kyon: Kabhi-kabhi score isliye girta hai kyunki galat info report ho gaya hota hai.

Tips:

- CIBIL ki site se free report saal me 1 baar lo

- Galat entries ko dispute karo

- Loan repayment ka proof sambhal ke rakho

6. Purane Credit Accounts Band Mat Karo 📂

📌 Kyon: Lambi credit history score ke liye acchi hoti hai.

Tips:

- Apna pehla credit card chhoti spends ke liye active rakho

- Good history wale old loan accounts close mat karo

7. Outstanding Dues Pehle Clear Karo 💪

📌 Kyon: Pending dues chhote ho ya bade, jab tak clear nahi hote, score ko neeche kheechte hain.

Tips:

- High-interest loans se repayment start karo

- Settlement last option ho (aur yeh score ko hurt karta hai)

8. Credit Cards Smartly Use Karo 💳

📌 Kyon: Credit card se score build hota hai… ya bigadta hai.

Tips:

- Hamesha full payment karo, sirf minimum due nahi

- Cashback/rewards ka use karo, lekin impulsive spending avoid karo

- Utilization low rakho

9. Authorized User Bano 👨👩👧

📌 Kyon: Family member ke acchi history ka benefit tumhe mil sakta hai.

Tips:

- Trusted family member se request karo tumhe add karein

- Unke payments bhi time pe hone chahiye

10. Patience Rakho, Consistent Raho 🏁

📌 Kyon: CIBIL score overnight improve nahi hota.

Tips:

- 6–12 mahine tak consistently follow karo

- “Score improvement services” se bacho – scams bahut hain

Bonus Tip – Credit Builder Loan Try Karo 📈

Kuch Indian fintech apps credit builder loan dete hain – tum monthly chhota amount repay karte ho, end me paise wapas milte hain. Yeh sirf score improve karne ke liye hota hai.

Examples: Paytm Postpaid, KreditBee, Stashfin.

CIBIL Improve Karte Time Ye Mistakes Mat Karo 🚫

- Sirf minimum due pay karna

- Multiple personal loans ek saath lena

- Kisi unreliable dost ke liye co-sign karna

- Electricity/phone bills ignore karna (kuch report hote hain)

Real-Life Story – 610 Se 780 in 9 Months 📖

Sneha (Pune) ka score 610 tha kyunki usne ₹25,000 personal loan COVID time pe default kiya.

Usne:

- 3 mahine me sab dues clear kiye

- Credit card ka sirf 20% limit use kiya

- ₹10,000 ka loan liya aur 6 months me repay kiya

- Har month score monitor kiya

Result? 9 mahine me 780 score, low interest pe home loan approve.

Final Words – [How to Improve CIBIL Score in India] Habits Pe Depend Karta Hai, Hacks Pe Nahi 🙌

Score improve karna ek habit hai – responsible borrowing, time pe payments, low utilization. Koi magic trick nahi hai.

Chahe tum abhi apna pehla credit card le rahe ho ya ghar ka loan plan kar rahe ho, start today. 6 months baad tum khud dekhoge – loan approvals smooth, interest rates low, aur tension zero.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪