Credit Card Reward Points in India – Secret Hacks to Earn ₹50,000+ Every Year 💳💰

Yaar, agar tumko free travel, shopping vouchers, ya cashback pasand hai na, toh tum ek aisi cheez ignore kar rahe ho jo literally goldmine hai – Credit Card Reward Points in India.

Haan, ye chhote-chhote points jo tum har swipe par earn karte ho, wo milke ban sakte hain free flights, 5-star hotel stays, gadgets, ya ₹50,000+ ke rewards har saal — bas thoda smart khelna padega (pun intended 😜).

Problem yeh hai ki zyada log points toh earn karte hain, par unko maximize kaise karein yeh nahi pata. Aaj main tumhare saath share karunga apne personal hacks jo main India mein test karke use karta hoon — bina extra kharcha kiye.

Credit Card Reward Points in India Hotey Kya Hain? 🤔

Simple language mein: jab bhi tum credit card se shopping, dining, fuel, ya bill payment karte ho, tumhe points milte hain. In points ko tum vouchers, products, bill payment credit, ya air miles mein convert kar sakte ho.

Example:

- HDFC Regalia → 4 points per ₹150 spend

- SBI Card PRIME → 5 points per ₹100 spend (groceries & dining)

- Axis Magnus → crazy rewards on travel bookings

Ab agar tum smartly spend karna seekh lo, toh tum bina extra paisa kharche points ka mountain bana sakte ho.

Agar tum credit card ke rules aur interest rate ko detail mein samajhna chahte ho, toh RBI ki website par jaake credit card regulations padh sakte ho.

Kyun Zyada Log Reward Points Ka Faayda Nahi Utha Paate 🚫

Maine notice kiya hai, Indians mostly ye 3 mistakes karte hain:

- Card ka reward structure nahi padhte – Benefits booklet kaun padhta hai? (Padho bhai!)

- Bade expenses debit card/cash se karte hain – Free points ka chance gaya!

- Low-value redemption karte hain – Matlab toaster le liya instead of free flight 😅

Hack #1: Apne Spending Habits Ke Hisab Se Card Choose Karo 🃏

One rule — one size fits all yahan kaam nahi karta. Card tumhare spending habits match karna chahiye.

Example:

- Travel zyada? → Amex Platinum Travel Card (free flights + Taj vouchers)

- Foodie ho? → SBI PRIME ya HDFC Diners Privilege (bonus points on dining)

- Online shopping addict? → Flipkart Axis Bank Card ya Amazon Pay ICICI Card

💡 Pro Tip: Bank ke salesman ki baat sunke mat le lena. Check karo:

- Points per ₹100

- Bonus categories

- Annual fee vs benefits (benefits at least 2x fee)

Hack #2: Har Possible Payment Credit Card Se Karo (Aur Bill Time Pe Clear Karo) 💡

Agar tum ₹50K+ reward points chahte ho, toh mobile recharge se leke LIC premium tak sab credit card se pay karo.

Examples:

- Electricity bill: ₹2,000/month → ₹24K/year

- Groceries: ₹8,000/month → ₹96K/year

- Dining: ₹3,000/month → ₹36K/year

- Fuel: ₹4,000/month → ₹48K/year

- Online shopping: ₹6,000/month → ₹72K/year

2% reward rate pe bhi tum ₹5,000+ earn karoge. Aur jab travel bookings, EMI purchases, offers add karo, toh ₹50K cross ho jayega.

Hack #3: Sign-up Bonuses & Welcome Offers Ka Full Faayda Uthao 🎁

Premium credit cards India mein joining time pe hi ₹5K–₹10K worth rewards de dete hain.

Examples:

- HDFC Regalia → 2,500 points on joining (worth ₹1,250+)

- SBI PRIME → ₹3K worth gift voucher (Yatra, Pantaloons, etc.)

- Axis Magnus → 25,000 points on milestone spend

💡 Pro Tip: Agar tum badi purchase plan kar rahe ho, pehle new card le lo — welcome bonus hit karo, phir redeem karo.

Hack #4: Bonus Categories & 5X/10X Offers Track Karo 📈

Kuch cards special spending categories pe 5X ya 10X reward points dete hain.

- HDFC SmartBuy → 5X–10X points (Amazon, Flipkart, MakeMyTrip)

- Amex Membership Rewards → Monthly milestone pe bonus points

- Axis Magnus → ₹1L spend/month pe 25,000 points

Example: ₹40K ka flight ticket book kiya HDFC SmartBuy se at 10X → ₹6K worth points ek shot mein.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Hack #5: Rent, School Fees & Insurance Bhi Card Se Pay Karo 🏠📚

Pehle yeh mostly bank transfer hota tha, ab CRED, NoBroker, Paytm, MobiKwik apps se credit card payment possible hai (thoda processing fee hota hai, par rewards se cover ho jaata hai).

Example:

Rent ₹20K/month × 12 = ₹2.4L/year → 1.5% reward = ₹3,600 (plus milestone benefits)

Hack #6: Family Points Pool Karo Aur Badi Redemption Karo 👨👩👧👦

Kuch loyalty programs jaise Vistara Club ya Air India Flying Returns family pooling allow karte hain.

Instead of chhote rewards, combine points → Goa return tickets for full family free mein! ✈️

Hack #7: Purchases Festival Sales Pe Time Karo 🕒

Diwali, Amazon Great Indian Festival, Flipkart Big Billion Days pe banks partner hote hain aur bonus rewards dete hain.

Example:

- ICICI Amazon Pay Card → extra 5% back during sales

- HDFC → 10X rewards during Flipkart BBD

Laptop, fridge, furniture — sab yahi time pe lo.

Hack #8: High-Value Redemption Hi Karo 🎯

Bohot log points waste kar dete hain low-value redemption pe.

- ❌ Bad: 2,000 points → ₹500 voucher (₹0.25/point)

- ✅ Good: 10,000 points → ₹5,000 flight (₹0.50/point)

- 🔥 Best: Airline/hotel transfer → ₹1+/point value

Rule: ₹0.50 per point se kam value pe redeem mat karo.

Hack #9: Discounts + Reward Points Combine Karo 🔄

Example: MakeMyTrip pe hotel book karo:

- 10X points card portal se

- ₹1K MMT coupon discount

Dono benefits ek saath milte hain — double dhamaka!

Hack #10: Har Saal Card Review Karo 🔍

Spending habits badalte hain, card benefits bhi. Har saal check karo:

- Bonus categories ka use ho raha hai?

- Annual fee worth hai?

- Upgrade/downgrade ka time aa gaya?

Card switch karke tum apne rewards 30–50% badha sakte ho.

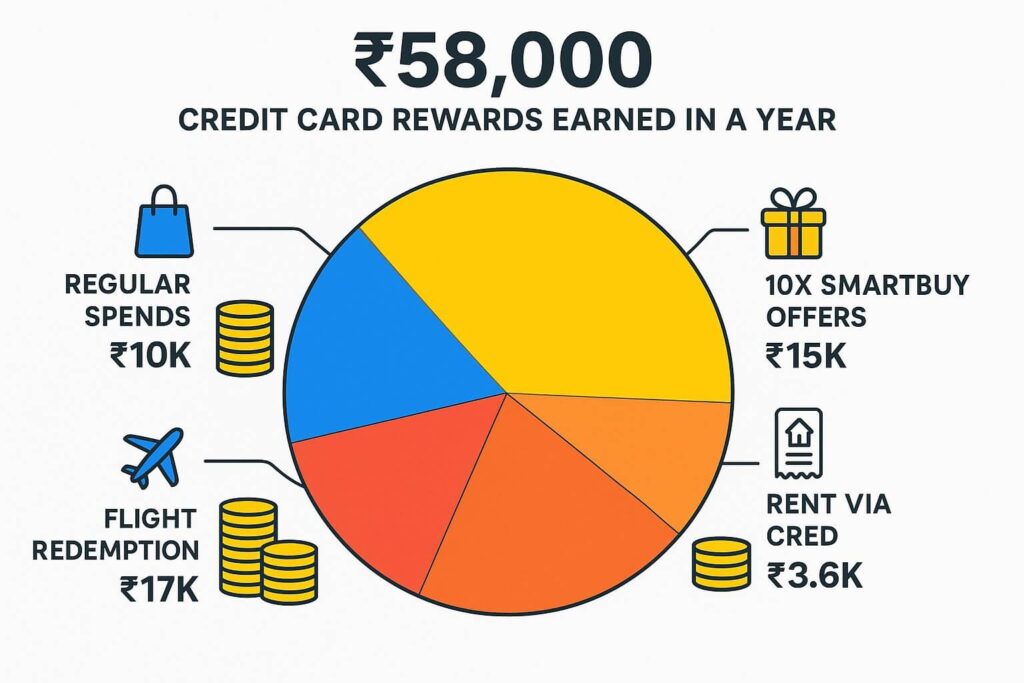

Real Example: Mainne Kaise ₹58K Rewards Earn Kiye Last Year 🏆

- Regular spends (₹5L @ 2%) → ₹10K

- HDFC 10X SmartBuy → ₹15K

- Axis Magnus sign-up bonus → ₹12.5K

- Rent via CRED → ₹3.6K

- Vistara flight redemption → ₹17K

Total: ₹58,100 — bina ek paisa extra kharche.

Final Thoughts – Credit Card Reward Points in India Ka Full Faayda Lo 🏁

₹50K+ rewards earn karna bilkul possible hai agar tum reward points ko real paisa samjho.

Formula simple hai:

- Apne lifestyle ke hisaab se sahi card choose karo

- Har possible expense card se pay karo (bill time pe clear)

- Bonus/milestone rewards ka pura use karo

Bank tumse paisa kamaye, yeh normal hai. Par tum bhi unse free trips & gadgets kama sakte ho. Ek baar tumne apni pehli free international trip points se book ki, tum phir kabhi casual swipe nahi karoge. 🚀

Bharat mein banking aur credit card usage ke trends ke liye Economic Times ka coverage kaafi helpful hai.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪