Buy vs Rent India – Smart Money Formula for Home Decisions 🏠💡

Bhai, ek baat batao — tumhara job ab stable ho gaya hai, mummy-papa roz bol rahe hain “Beta, ab apna ghar le lo”, aur tum raat ke 1 baje MagicBricks, 99acres ya NoBroker pe flats dekh rahe ho.

Aur dimaag me ek hi sawaal ghoom raha hai — “Ghar khareedna sahi rahega ya rent pe rehna better hai?”

Aaj ke time me Buy vs Rent India ka debate bohot hot ho gaya hai. Property prices sky-high hain, home loan ke interest rate EMI ka bura haal kar dete hain (RBI repo rate updates), aur rental options pehle se kaafi flexible ho gaye hain.

Chalo iss confusion ko ekdum simple words, real examples, aur ek Smart Money Formula ke saath solve karte hain — taaki tum apne liye best decision le sako.

Kyu yeh decision itna tricky ho gaya hai 🤔

Hamare parents ke zamane me buying ka matlab tha smart choice. Prices low the, loans chhote the, aur log ek hi sheher me zindagi nikal dete the. Lekin aaj ka scene alag hai:

- Metro me prices bohot high

Example: Mumbai suburbs me ek 2BHK ₹1.2–1.5 crore ka milta hai (Economic Times report). - Job switching zyada hota hai

Millennials aur Gen Z kaam aur cities dono frequently change karte hain. - Rent options zyada flexible

Fully furnished flats, co-living spaces, no-broker deals — sab kuch milta hai. - Interest rates ka pinch

~8% home loan pe ₹1 crore ka 20 saal ka EMI ~₹83,000 hota hai.

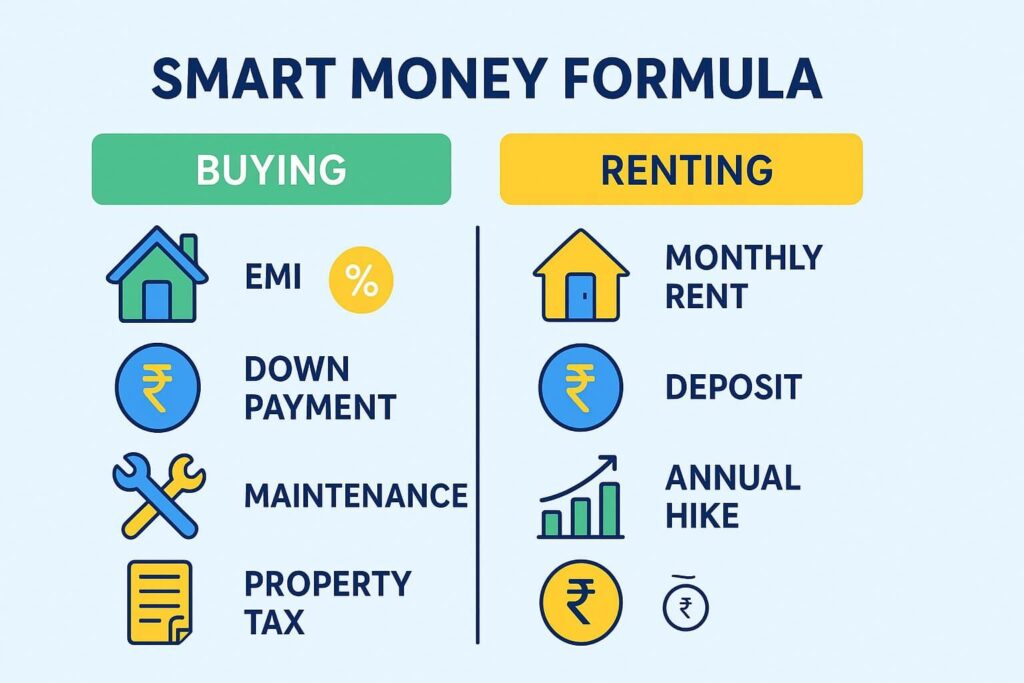

Smart Money Formula 📊

Buy vs Rent India decide karte waqt sirf rent vs EMI dekhna galat hai. Full picture dekho:

Total Cost of Buying = Down Payment + (EMI × Loan Tenure) + Maintenance + Property Tax – (Expected Appreciation)

Total Cost of Renting = (Monthly Rent × Years) + Security Deposit + Annual Rent Hike

Agar 10–15 saal me buying ka cost kam ho ya property value investment return se kaafi zyada badhe, toh buy karo. Warna rent pe rehkar bacha hua paisa invest karo.

Real-Life Example 📍

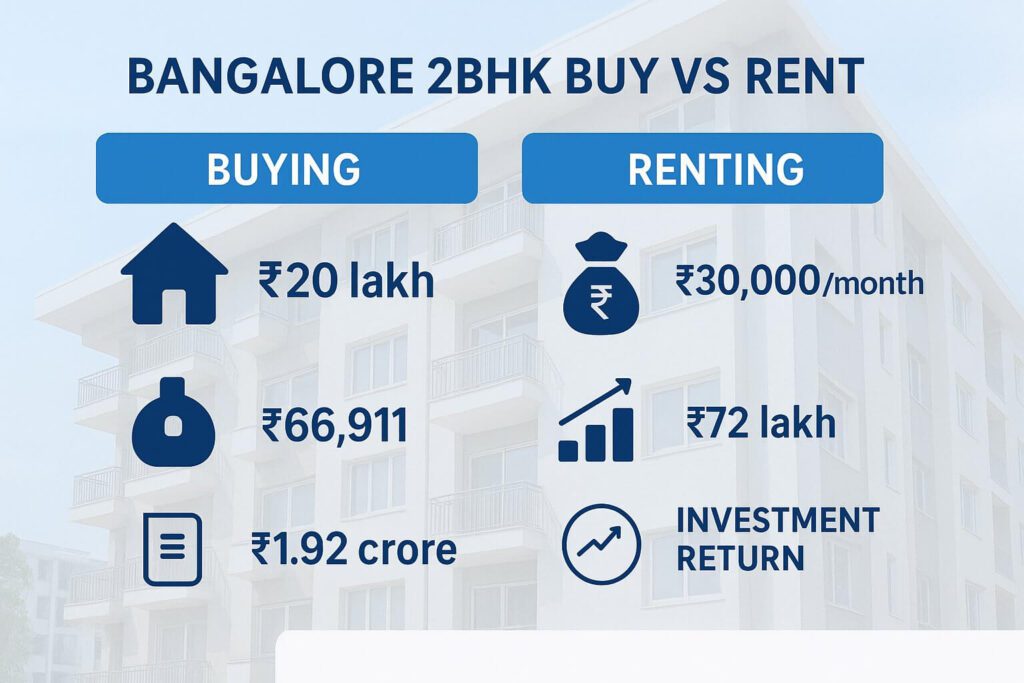

Scenario:

- City: Bangalore (Whitefield)

- 2BHK price: ₹1 crore

- Rent: ₹30,000/month

- Home Loan: ₹80 lakh @ 8% for 20 years

Buying:

- Down Payment: ₹20 lakh

- EMI: ₹66,911/month → ~₹8 lakh/year → ₹1.6 crore in 20 years

- Maintenance + Taxes: ₹5,000/month → ₹12 lakh in 20 years

- Total Cost: ₹1.92 crore

- Property appreciation to ₹2 crore → Net gain ₹8 lakh

Renting:

- Rent: ₹30,000/month → ₹72 lakh in 20 years (5% annual hike)

- Security Deposit: ₹1.8 lakh (refundable)

- ₹20 lakh down payment mutual funds me invest @12% → ~₹1.9 crore in 20 years

💡 Result: Is example me rent + invest > buy, unless property kaafi zyada appreciate kare.

Decision lene se pehle yeh factors socho 📝

1. City & Location

- Metro (Mumbai, Delhi, Bangalore): Buying kaafi mehenga padta hai, rent smart option hota hai.

- Tier-2 cities (Jaipur, Indore, Lucknow): Prices affordable, buying feasible.

2. Job Stability

- 3–5 saal me relocation possible? → Rent better.

- 10+ saal ek hi city me rehoge? → Buying samajh aata hai.

3. Lifestyle Needs

- Buying: Renovation freedom, ownership pride.

- Renting: Flexible shifting, upgrade option.

4. Financial Readiness

- Buying: 20–30% down payment, stable income, emergency fund required (SEBI on financial planning).

- Renting: Kam upfront cost, zyada liquidity.

Buying in India – Pros & Cons 🏡

Pros:

- Long term asset build hota hai

- Stability & ownership ka feel

- Rent hike ka tension nahi

- Future me rent pe de sakte ho

Cons:

- Huge down payment + EMI commitment

- Maintenance & taxes

- Liquidity problem (jaldi bechna mushkil)

- Price stagnation ka risk

Renting in India – Pros & Cons 🔑

Pros:

- Low upfront cost

- Easily shift kar sakte ho

- Maintenance ka headache nahi

- Saved money invest karke high return

Cons:

- Asset build nahi hota

- Rent hike har saal

- Landlord kabhi bhi vacate karwa sakta hai

- “Apna ghar” ka feel missing

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Market Trends jo Buy vs Rent India ko affect karte hain 📈

- RERA rules se transparency badhi hai

- Rental yields low (2–3%) → Buying for rent kaafi cases me worth nahi

- Property apps (NoBroker, MagicBricks) ne process easy kar diya

- PMAY jaisi govt schemes se first-time buyers ka cost kam ho sakta hai

Mera personal take 🎯

Agar tum 20s–early 30s me ho, stable job ke saath investing discipline follow karte ho, toh rent + invest ka combo often better hota hai — except agar:

- Tumhe market rate se sasta deal mil raha ho

- Tier-2/3 city me ho jaha growth fast hai

- Tum 15–20 saal ek hi jagah settle hone wale ho

Quick Checklist ✅

Before deciding Buy vs Rent India, puchho khud se:

- Down payment (20–30%) without emergency fund touch?

- Ek hi city me 10+ saal ka plan?

- EMI < 30–35% monthly income?

- Property growth potential strong?

Agar zyada “No” aa rahe hain → Filhal rent pe raho.

Final Word – Buy vs Rent India 🏆

Ghar lena sirf financial nahi, emotional decision bhi hai. Apne life stage, finances, aur future plans ke basis pe choose karo — society pressure pe nahi.

Renting ka matlab paisa waste nahi hota — bacha hua paisa sahi jagah invest karke tum apna wealth faster grow kar sakte ho.Buying karo toh clear plan ke saath karo, EMI ka bojh uthake life ka maza kharab mat karo.

End me, smart money formula simple hai — numbers + lifestyle balance. Ghar tumhare life ko support kare, life ghar ke loan ko nahi.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪