Expiry-Day SIP Investing: Kaise Ye Timing Hack 1st-of-Month Myth Ko Hara Sakta Hai 💡

Agar tum SIP investor ho, toh 90% chance hai ki tumhari SIP timing strategy default 1st of the month pe set hoti hogi.

Ye default hota hai jo log generally change hi nahi karte.

Lekin ek SIP timing strategy hai jo kuch smart investors use karte hain — ek chhota sa tweak jo long term mein tumhe thoda extra return de sakta hai.

Iska naam hai Expiry-Day SIP Investing. Aur haan, iska koi lena-dena expired bread ya milk se nahi hai 😅.

Yeh strategy stock market ke monthly F&O expiry day ke saath SIP date align karne ka game hai.

Sounds thoda geeky? Chill! Main tumhe simple words, real-life example aur Indian context ke saath samjhata hoon ki ye chhoti si date shift kaise tumhare 1st-of-month SIP myth ko beat kar sakti hai.

Kya hai ye “1st-of-Month” SIP Myth?

Jab tum mutual fund SIP set karte ho, toh AMC ya app (Groww, Zerodha Coin, Kuvera, etc.) default date 1st ya 5th rakh dete hain.

Lagta neat hai — naye mahine ke saath fresh investment.

Par problem hai herd timing. Jab lakhon log ek hi din SIP karte hain, mutual funds ko ek saath bohot paisa milta hai aur wo us din ke market price pe hi buy karte hain.

Result? Tumhe hamesha best NAV nahi milta.

Toh Fir Ye Expiry-Day SIP Strategy Kya Hai?

Insider hack simple hai:

1st ko invest karne ke bajay apna SIP monthly F&O expiry day pe ya uske agle din schedule karo (jo usually mahine ka last Thursday hota hai).

Why? Kyunki expiry ke aas-paas market mein zyada volatility hoti hai. Traders apne position square off karte hain, kabhi kabhi short-term dip milta hai.

Aur jab market niche hota hai, tumhare fixed SIP amount se zyada units milte hain.

F&O Expiry Day Quick Recap

- India mein derivatives contracts (Futures & Options) ka expiry har mahine ke last Thursday hota hai.

- Is din trading volume high hota hai, prices upar-niche hote hain.

- Long-term investor ke liye yeh short-term dip ek discount shopping day jaisa hota hai.

Kaise Kaam Karta Hai Ye SIP Timing Strategy

- Expiry date identify karo har mahine.

Example: August mein expiry 28 August (Thursday) ko hai. - SIP date expiry day pe ya uske agle din rakh do.

- Over time, tum kabhi-kabhi lower NAV pe buy kar paoge compared to 1st-of-month investors.

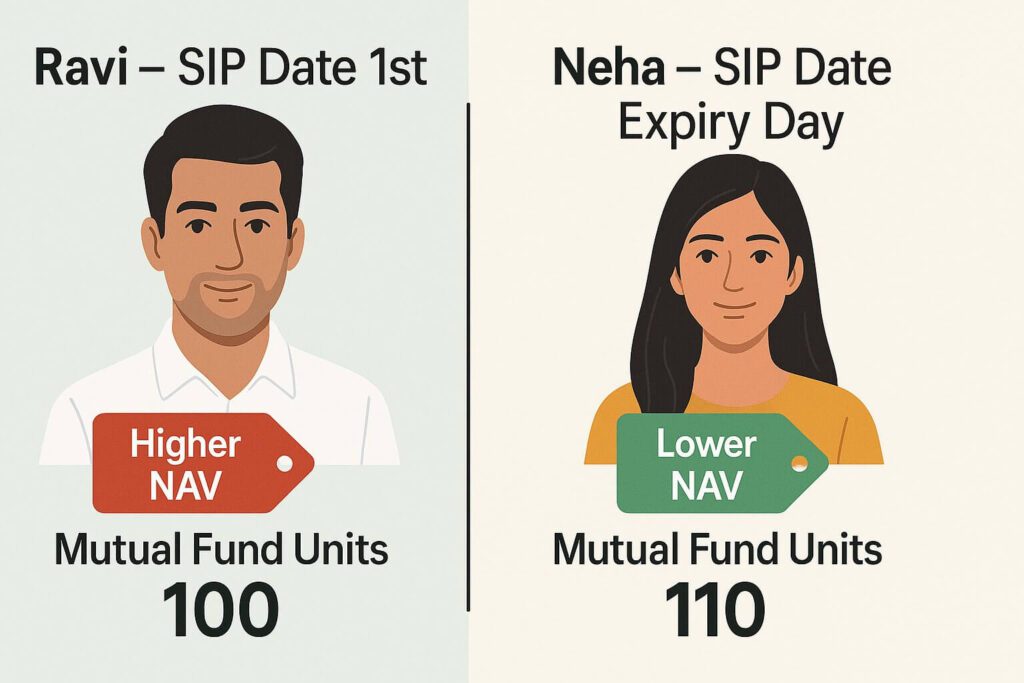

Real Example: ₹5,000 SIP in Nifty 50 Index Fund

- Ravi → SIP date: 1st of every month

- Neha → SIP date: Expiry day every month

Ek saal mein 6 mahine aise aaye jab expiry day pe market dip tha. Neha ne wahi ₹5,000 mein zyada units liye.

Sirf 0.5%-1% average NAV difference bhi 10–15 saal mein compounding ke through kaafi bada farq laa deta hai.

(Compounding ka long-term impact Investopedia bhi explain karta hai .)

Kyun Kaam Karta Hai (Market Psychology + Behavior)

- Crowd Effect → Early month SIPs = bulk buying, NAV slightly high.

- Expiry Volatility → Traders ke positions adjust hone se prices thode time ke liye niche aa sakte hain.

- Contrarian Timing → Herd ke opposite chal kar better price milne ka chance.

Kya Har Mahine Kaam Karega?

Nahi. Kabhi expiry day bullish hota hai, kabhi dip milta hai.

Lekin tumhe har mahine jeetna zaroori nahi. 10–15 saal mein average NAV thoda bhi improve hua, compounding magic karega.

Expiry-Day SIP Kaise Set Kare

Option 1: Fixed Date Near Expiry

- 27th ya 28th rakh lo har month ka. Zyada manual kaam nahi hoga.

Option 2: Manual Monthly Lumpsum

- Har mahine expiry date check karo aur utna hi amount lumpsum dal do. Thoda extra kaam hai par timing accurate milegi.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

SIP Timing Strategy Quick Checklist

✅ Best for index funds, large-cap funds, diversified equity funds

✅ Debt funds mein kaam nahi karega — expiry volatility ka effect nahi hota

✅ Consistent raho — timing ke chakkar mein month skip mat karo

✅ Ye ek micro-optimization hai, magic trick nahi

Common Myths About SIP Dates

Myth 1: “SIP date ka koi farq nahi padta.”

Truth: Long-term consistency important hai, par date tweak se small edge mil sakta hai.

Myth 2: “Expiry day sirf traders ke liye hota hai.”

Truth: Traders volatility banate hain, investors uska fayda le sakte hain.

Myth 3: “Ye bohot complicated hai.”

Truth: Ek baar date set kar di, toh autopilot ho jata hai.

Relatable Scenario for Young Indians

Mahine ka last Thursday hai. Dost weekend trip ki planning kar rahe hain ya Myntra sale mein cart bhar rahe hain.

Tum casually dekhte ho ki market 1% niche hai — expiry day ka asar. Tumhara SIP auto-debit hota hai, aur tum cheaper NAV pe buy kar lete ho.

10 saal baad — wo chhote-chhote dips jo tumne catch kiye? Wahi tumhare portfolio ko thoda extra boost dete hain compared to dost ka.

Risks & Limitations

⚠ Short-term unpredictable hota hai — kabhi expiry day rally ho sakta hai

⚠ Overthinking se bachna — perfect timing ka wait karoge toh investing delay ho jayegi

⚠ Cut-off time dhyan rakho — same-day NAV tabhi milega jab time se pehle invest ho

Bonus Tip: Step-Up SIP + Expiry-Day Timing

Agar tum har saal apna SIP amount badhate ho (Step-Up SIP), toh expiry-day strategy aur powerful ban jati hai — kyunki bigger amounts bhi lower NAV pe invest hote hain.

Final Word: Kya Ye Worth Hai?

Agar tum already SIP kar rahe ho, toh ye SIP timing strategy ek smart tweak hai. Overnight returns double nahi honge, par 0.5%-1% extra annual return over decades = lakhs ka extra paisa retirement pe.

25 saal ki age mein ₹10,000/month invest karke 20 saal baad tumhare paas kaafi extra wealth ho sakti hai — sirf date shift karke.

💡 Key takeaway: Default 1st-of-month crowd follow mat karo. Thoda date adjust karke expiry day ke aas-paas invest karo — market ke chhote dips tumhare long-term returns ko silently boost kar denge. 🚀

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪