Money and Mental Health in India – Paisa aur Peace of Mind ka Real Connection 🧠💰

Soch ke dekho yaar – bank account me paisa sirf numbers nahi hote, wo directly tumhari khushi, dosti, aur relationships ko impact karte hain.

India me 18–35 age group ke logon ke liye financial stress ek hidden mental health problem ban chuka hai.

Kabhi student loan ka pressure, kabhi EMI, kabhi ghar ka rent, aur upar se Instagram pe sab log Bali trip pe dikhte hain ya nayi car flaunt karte hain 🚘🌴. Ye sab mila ke money aur mental health ka connection aur bhi strong ho jaata hai.

Is blog me hum baat karenge Money and Mental Health in India, financial stress ka impact happiness pe, aur sabse important – kaise apne finances ko balance karke apni mental well-being ko protect karein.

Kyun Zaroori Hai Money aur Mental Health ki Baat Karna?

India me paiso ke baare me openly baat karna thoda awkward lagta hai. Bachpan se suna hoga:

👉 “Paise ped pe nahi ugte.”

👉 “Shaadi ke baad settle ho jaoge.”

Lekin reality me:

- Students loans aur credit card EMIs ekdum headache ban jaate hain.

- Bahut saare youngsters apne parents ko support bhi karte hain aur apne future ke liye bhi save karna padta hai.

- Social media pressure alag hi level pe hai – sabko lagta hai dusre log zyada successful hain.

Result? Jab money out of control lagta hai, anxiety aur stress aate hain. Aur jab mental health kharab hoti hai, toh hum aur bhi galat financial decisions le lete hain. Ye ek vicious cycle hai jo todna bahut zaroori hai.

(India me mental health awareness ke baare me detail data Wikipedia ke Mental Health in India overview me bhi clearly mention hai 👉

https://en.wikipedia.org/wiki/Mental_health_in_India)

Kaise Financial Stress Tumhari Happiness Ko Affect Karta Hai?

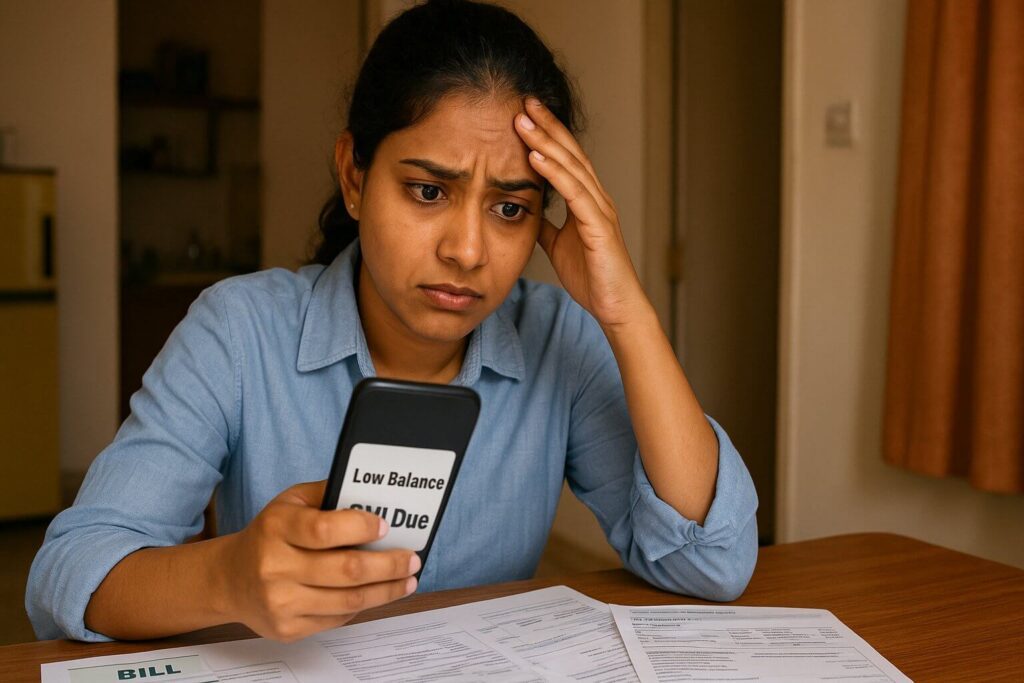

1. Bill aur EMI Anxiety 😰

Maan lo tum 26 ho, Bangalore me job kar rahe ho. Salary 1 tareekh ko aayi, lekin 10 tak rent, credit card bill aur EMIs chala gaya. Baaki mahine bhar paisa stretch karna struggle lagta hai.

Result? Pizza order karne me bhi guilt feel hota hai. Ye guilt dheere dheere stress aur unhappiness me badal jaata hai.

2. Relationships Me Tension 💔

India me paisa ek personal nahi, family matter hota hai.

- Couples khud ke spending priorities pe argue karte hain (shopping vs savings).

- Parents expect karte hain ki tum ghar ka kharcha do, chahe tum khud struggle kar rahe ho.

- Dost disturb ho jaate hain jab tum group trips ya fancy dinners afford nahi kar paate.

Paisa fights are one of the biggest reasons for relationship stress.

3. नींद aur Health Problems 😴

Unpaid bills ya EMI ka thought raat bhar sulaata nahi hai. Lack of sleep =

- Kaam pe focus khatam

- Chidh-chidhapan

- Weak immunity

- Lifestyle diseases ka risk (jo India me already common hain)

Money stress sirf dimaag tak limited nahi hota – body tak impact karta hai.

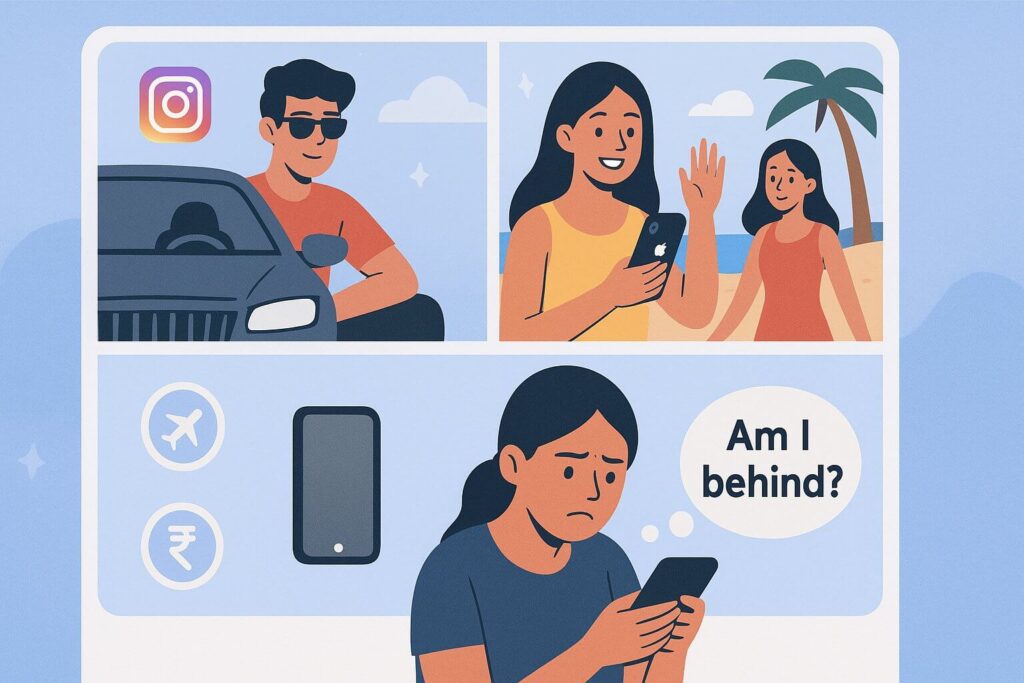

4. Insta Comparison Culture 📱

Sabko lagta hai doston ke paas iPhone hai, nayi gaadi hai, crypto investment se paisa double ho raha hai. Aur hum peeche reh gaye.

Ye constant comparison self-esteem tod deta hai. Aur fir log sirf “fit in” karne ke liye overspend kar dete hain – jo stress aur bada deta hai.

5. Career Pressure 💼

Kabhi kabhi high-paying job choose karni padti hai chahe wo pasand na ho. Short-term paisa milta hai, lekin long-term unhappiness, burnout aur stress badhta hai.

Real-Life Indian Examples

- Student Loan: Delhi ka 24-year-old MBA grad ₹50,000 earn karta hai, lekin aadha loan repayment me chala jaata hai. Khud ko “settled” bol nahi paata.

- Mumbai Rent: IT professional ₹1 lakh kamata hai, lekin 40% rent me chala jaata hai. Savings mushkil hai.

- Family Obligations: Hyderabad ka 30-year-old apne parents ko support karta hai aur apni shaadi ke liye save bhi karna padta hai – anxiety alag hi level pe.

Ye examples clearly dikhate hain ki Money and Mental Health in India har sheher, har job aur har background me linked hai.

Kaise Pehchaane ki Money Stress Tumhari Mental Health Ko Affect Kar Raha Hai?

- Har chhoti baat pe paiso ki tension lena

- Bank balance check karne se bachna

- Apne upar kharch karne me guilt feel karna

- Family ya partner ke saath finance pe fights

- नींद kharab hona aur kaam pe focus lose karna

Agar ye sab tumhe lagta hai – toh action lene ka time aa gaya hai.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Breaking the Cycle: Paisa aur Peace Ko Balance Kaise Kare?

1. Acknowledge Karo ✍️

Sabse pehle accept karo ki paisa mental health ko impact karta hai. Apni financial worries likho – debt? savings? unstable income? Clarity aayegi.

2. Simple Budget Banao 📊

Budgeting matlab restriction nahi, clarity hai. Try 50-30-20 rule:

- 50% = needs (rent, groceries, bills)

- 30% = wants (Swiggy, shopping, outings)

- 20% = savings / debt repayment

Apps jaise Walnut, ET Money, Jupiter ya even Paytm Money use kar sakte ho.

(India me financial literacy aur safe money habits ke liye RBI ka official Financial Education portal bhi kaafi useful hai 👉

https://www.rbi.org.in/FinancialEducation)

3. Emergency Fund Rakho 🏦

3–6 months ke kharche ek alag savings account me rakho. Ye job loss ya medical emergency ke time best mental peace deta hai.

4. Mindful Spending Adopt Karo 🧘

Khud se pucho: “Kya mujhe ye zaroori hai, ya sirf impress karne ke liye kharid raha hoon?”

Unnecessary kharche cut karke apni priorities (jaise travel, health, learning) pe paisa lagao.

5. Money Pe Openly Baat Karo 💬

Apne partner, doston, ya family ke saath paise ki baat karo. Isse guilt aur misunderstandings kam hote hain.

6. Professional Help Lo Agar Zaroori Ho 🩺

India me affordable help available hai:

- Financial advisors (budgeting, investments, debt planning ke liye)

- Therapists (apps like YourDost, MindPeers, BetterLyf) jo money anxiety handle karne me help karte hain.

7. Short-Term Comparison Chhodo, Long-Term Goals Pe Focus Karo 🎯

Dusron ko compare karne ke bajaye apna growth track karo.

- Pehli baar ₹50,000 save kiya? Celebrate!

- Ek credit card clear kiya? Confidence boost!

Ye chhoti chhoti wins tumhari self-esteem improve karti hain.

Daily Habits for Paisa + Peace

✅ Auto SIP ya recurring deposit set karo

✅ BNPL (Buy Now, Pay Later) se bacho

✅ Insta-scrolling limit karo

✅ New skills me invest karo → higher income

✅ Meditation / yoga practice karo

Final Thoughts: Money and Mental Health in India

Sach ye hai ki paisa zaroori hai – lekin tumhari mental health aur khushi usse bhi zyada precious hai.

Financial stress sleepless nights, fights, aur constant guilt deta hai. Lekin awareness, budgeting aur help lene se tum apne paiso ko control kar sakte ho – instead of paisa controlling you.

Young Indians ke liye balance hi asli success hai. Financial freedom ka matlab crores kamaana nahi, balki paiso ki tension ke bina peaceful life jeena hai.

Next time bank balance check karo, mental balance bhi check karna mat bhoolna. Jab paisa aur peace saath hote hain, tabhi asli happiness aati hai. ✨

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪