Best Cashback Credit Card India – Extra Benefits Lo, Extra Spend Nahi 💳💰

Socho yaar, tum har month groceries, Zomato orders, Amazon shopping, ya weekend movie tickets ke liye apna credit card swipe karte ho. Ab imagine karo, agar har swipe ke saath tumhe paise wapas milne lage toh? Sounds awesome na? 😎

Bas wahi kaam karta hai cashback credit card – jitna spend, utna benefit.

Aaj main tumhe bataunga Best Cashback Credit Card India options, kaunsa card tumhare lifestyle ke liye best hai, aur kaise bina extra kharcha kiye tum apne rewards ko maximize kar sakte ho.

Cashback Credit Card Kya Hota Hai? 🤔

Simple language mein – jab tum card swipe karke kuch buy karte ho, bank tumhe us transaction ka ek percentage cash ke form mein wapas deta hai.

Jaise ki ek chhota sa thank you from the bank. (You can also read more about how credit cards work on Investopedia).

Example:

Agar tumhara card 5% cashback deta hai online shopping pe, aur tum ₹2,000 ke kapde Myntra se kharidte ho, toh tumhe ₹100 wapas milta hai. Year ke end tak, bina lifestyle change kiye, tum kaafi paisa save kar sakte ho.

Kyun Young Indians Ko Cashback Cards Pasand Hai

18–35 age group ke liye cashback cards ek dum must-have hai:

- Instant reward feeling – Travel points ke liye wait nahi karna padta

- Roz ke expenses cover – Grocery, fuel, bill payments, UPI spends

- Easy redemption – Cashback direct statement me adjust hota hai

- Flexible usage – Paisa kahin bhi use karo, koi restriction nahi

(India me credit card adoption trend ke numbers dekhne ke liye RBI’s official data check kar sakte ho.)

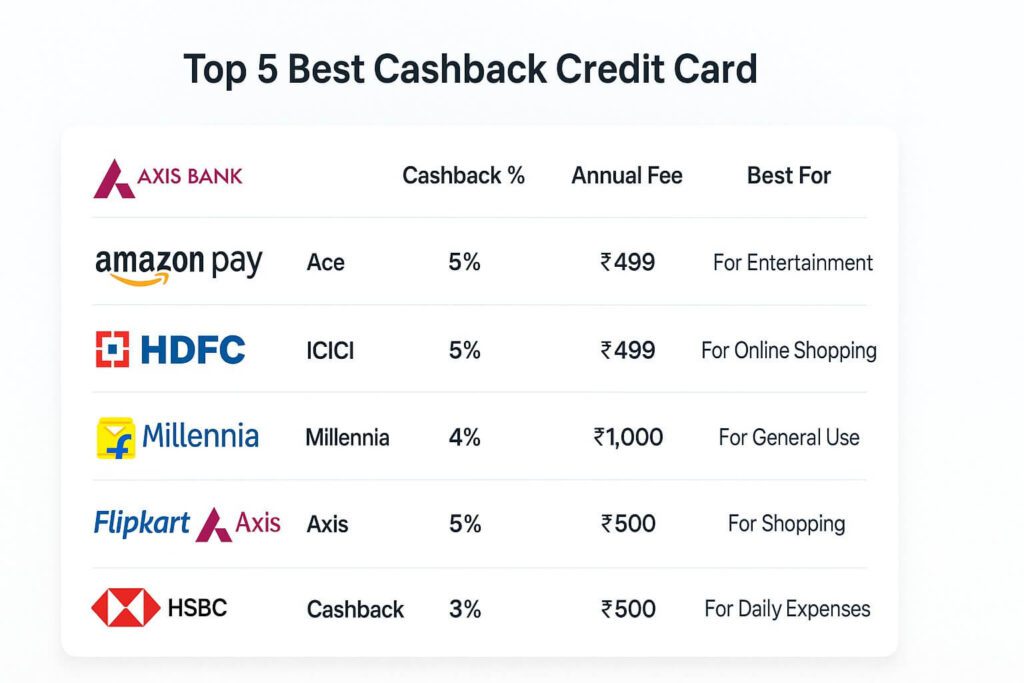

Top 5 Best Cashback Credit Card India

Yeh raha list jo students, working professionals, aur small business owners ke liye kaafi useful hai.

1. Axis Bank Ace Credit Card

- Cashback Rate: 5% bill payments & recharges via Google Pay, 4% on Swiggy/Zomato/Ola, 2% on others

- Annual Fee: ₹499 (waived if ₹10,000 monthly spend)

- Best For: Daily bill payments + food orders

- Example: ₹1,200 electricity bill GPay se + ₹2,000 Zomato order → ₹200–300 cashback har month.

2. Amazon Pay ICICI Credit Card

- Cashback Rate: 5% on Amazon (Prime), 3% non-Prime, 2% partners, 1% others

- Annual Fee: ₹0

- Best For: Frequent Amazon shoppers

- Example: Prime member ₹5,000/month Amazon spend → ₹250 cashback monthly = ₹3,000 yearly free.

3. HDFC Millennia Credit Card

- Cashback Rate: 5% on Amazon, Flipkart, BookMyShow, Myntra; 1% others

- Annual Fee: ₹1,000 (waived if ₹1 lakh yearly spend)

- Best For: Online shopping + entertainment combo users

- Example: ₹3,000 movie tickets + ₹30,000 online shopping = annual fee easily recovered.

4. Flipkart Axis Bank Credit Card

- Cashback Rate: 5% on Flipkart, 4% on Swiggy/Uber/PVR, 1.5% others

- Annual Fee: ₹500 (waived on ₹2 lakh yearly spend)

- Best For: Flipkart lovers + food delivery & travel users.

5. HSBC Cashback Credit Card

- Cashback Rate: 1.5% online spends, 1% others

- Annual Fee: ₹750 (first year free)

- Best For: Simple, no-category tracking lovers.

Apne Liye Best Cashback Credit Card Kaise Choose Karein

Pehle yeh questions pucho:

1. Tumhara major spend kahan hota hai?

- Amazon → Amazon Pay ICICI

- Bill payments & food delivery → Axis Ace

- Mixed shopping + entertainment → HDFC Millennia

2. Monthly spend kitna hai?

- Low spender → Zero/low annual fee cards

- High spender → High cashback rate wale cards

3. Simple chahiye ya category tracking okay hai?

- High % cashback cards → Thoda tracking chahiye

- Flat-rate cashback cards → Zero headache

Cashback Maximize Karne Ke Smart Tareeke (Bina Overspending)

Bohot log galti karte hain extra kharid ke liye cashback chase karke. Avoid karo yeh:

- Planned expenses pe card use karo – Electricity, rent (via apps), OTT subs, groceries

- Right merchant ke saath right card use karo – Flipkart shopping = Flipkart Axis, Zomato order = Axis Ace

- Bank offers ka fayda uthao – Festive sale me bank discount + cashback combine karo

- Full payment karo monthly – Interest (36–42% yearly) tumhara saara cashback kha jayega

- Cashback track karo – Kuch cards ka expiry hota hai

Common Mistakes Jo Avoid Karni Chahiye

- Extra shopping sirf cashback ke liye karna 😅

- Annual fee ignore karna

- Categories ka detail na padhna

- Late payment karke rewards ka pura faayda khatam kar dena

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Real-Life Example – Cashback Kitna Add Ho Sakta Hai

Rohan, 27, Bangalore me IT job karta hai aur Axis Bank Ace Credit Card use karta hai:

- Bill payments via GPay: ₹3,000/month → ₹150 cashback

- Zomato orders: ₹2,000/month → ₹80 cashback

- Other spends: ₹10,000/month → ₹200 cashback

Monthly Cashback = ₹430

Yearly Cashback = ₹5,160

Bina extra spend kiye, Rohan ne ek saal me ₹5,000+ kama liya.

Mera Pick – Best Cashback Credit Card India

Mujhe ek all-rounder choose karna ho toh Axis Bank Ace Credit Card best lagega – 5% utility bills + 4% food delivery ka combo kaafi logon ke lifestyle me fit ho jata hai.

Lekin golden rule yaad rakho – Best card wahi hai jo tumhare actual spending pattern ke saath match kare.

Final Thoughts

Best Cashback Credit Card India choose karna highest % reward chase karne ka game nahi hai, balki apne lifestyle ke saath perfect fit dhoondhne ka kaam hai.

Agar smartly use karo toh cashback card har transaction pe ek mini discount ki tarah kaam karega.

Bas 3 cheezein follow karo:

- Real spending habit ke hisaab se card lo

- Bill hamesha full pay karo

- Cashback ke liye overspending mat karo

Ab bas swipe karo, save karo… aur chill maro! 😄

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪