Living on ₹10,000 Salary? Here’s Exactly How to Budget Without Feeling Broke

Chalo sach bolte hain — ₹10,000/month salary mein survive karna toh tough hai hi. Har taraf se kharche tapak jaate hain: rent, khaana, recharge, travel, kabhi emergency…

Par agar thoda smart planning karo aur kuch low income budgeting tips follow karo, toh na sirf survive, balki save bhi kar sakte ho.

Yeh blog hai tumhare liye — jo abhi job start ki hai, intern ho, student ho ya part-time pe kaam kar rahe ho. Yahan milega full desi guide with [low income budgeting tips], jo realistic bhi hai aur relatable bhi.

Aur haan, broke wali feeling ko toh ab goodbye bolo 👋

Kya ₹10,000 Mein Sacchi Mein Guzaara Ho Sakta Hai?

Depends karta hai — kaha rehte ho aur kaise rehte ho.

Agar Tier 2/Tier 3 city mein ho ya metros mein PG ya family ke saath, toh thoda tight hai, but definitely doable.

🧑💼 Example: Ramesh, ek 24-year-old Swiggy delivery boy Jaipur mein, ₹10K/month mein reh raha hai — shared PG mein rehta hai, ghar ka khana khata hai, aur local bus use karta hai. Fir bhi ₹500–₹800 tak save kar leta hai har mahine.

Itna sab karne ke liye sacrifice nahi, strategy chahiye.

🪙 Step 1: Sabse Pehle Apne Khaarcho Ka Hisab Rakho

Sabse pehle dekhna hai ki paisa jaa kahan raha hai.

Chhoti city mein rehne wale ke liye ek sample monthly budget yeh ho sakta hai:

Expense Category | Budget (₹) |

Rent (PG/shared room) | ₹3,000 |

Khana + Groceries | ₹2,000 |

Travel (bus/metro) | ₹1,000 |

Phone + Internet (Jio) | ₹500 |

Emergency Fund | ₹500 |

Personal/Extras | ₹1,000 |

Savings (non-negotiable) | ₹2,000 |

Total | ₹10,000 ✅ |

📌 Har rupaye ka kaam set karo pehle se — yeh hota hai smart budgeting!

💡 Step 2: Top 7 Low Income Budgeting Tips Jo Sach Mein Kaam Aate Hai

Budget ka matlab yeh nahi ke sab kuch bandh kar do. Matlab hai — sahi cheezein pe focus karo.

Yeh rahe kuch [low income budgeting tips] jo ₹10,000 salary mein bhi kaam karte hain:

1. Zero-Based Budget Follow Karo

Mahine ki income ₹10,000 hai? Plan aise banao ke har ₹ ka kaam fixed ho jaye. Bank balance ₹0 ho na ho, planning balance zarur zero ho! 😄

➡️ Jaise: ₹3K rent, ₹2K food, ₹1K travel, ₹2K savings… aur plan complete.

2. Zomato Chhodo, Ghar Pe Khao 🍛

Food delivery toh budget ka biggest villain hai. Instead:

- Ghar pe daal-chawal ya poha bana lo

- D-Mart ya local bazaar se ₹1000 ka monthly grocery stock le lo

- Tiffin service bhi option hai — ₹1,500–₹2,000/month

Ghar ka khana = healthy + paisa bachao ✅

3. Paisa Track Karne Wale Apps Use Karo 📱

UPI se paisa udta hai, pata bhi nahi chalta? In apps ka use karo:

- Walnut

- Money View

- Goodbudget

Ye apps UPI se linked hoti hain aur automatically dikha deti hain ki paisa kahan gaya.

Budgeting tabhi hoti hai jab tumhe khud pata ho ki tumhara paisa kidhar jaa raha hai!

4. Chhoti Chhoti Leaks Ko Pakdo 🚫

Yeh kuch budget ke chhupke dushman hain:

- Daily ₹15–₹30 tapri wali chai + samosa = ₹600/month 😱

- OTT subscriptions ka jungle (Netflix, Prime, etc.) — shared plan ya cousin ka password use karo

- Amazon/Flipkart ke sales scroll mat karo bas!

Impulse kharche control karo, bank balance khud thank you bolega 😅

5. Travel Smart – Public Transport FTW 🚌

Daily auto ya cab lena = ₹50–₹100 ud gaya.

Instead:

- Metro ya bus ka monthly pass lo

- Rapido ya Bounce bike taxis sasti padti hai

- Office ya college wale ke saath ride share kar lo

Sirf ₹20/day bachaoge toh ₹600/month ka profit! 😎

6. Weekly ₹1,000 Cash-Only Rule Try Karo 💵

Har Monday ₹1,000 ATM se nikaalo aur wahi spend karo poore week ke liye.

Cash khatam = spending bandh. Yeh hack kamaal ka hai overspending control karne ke liye.

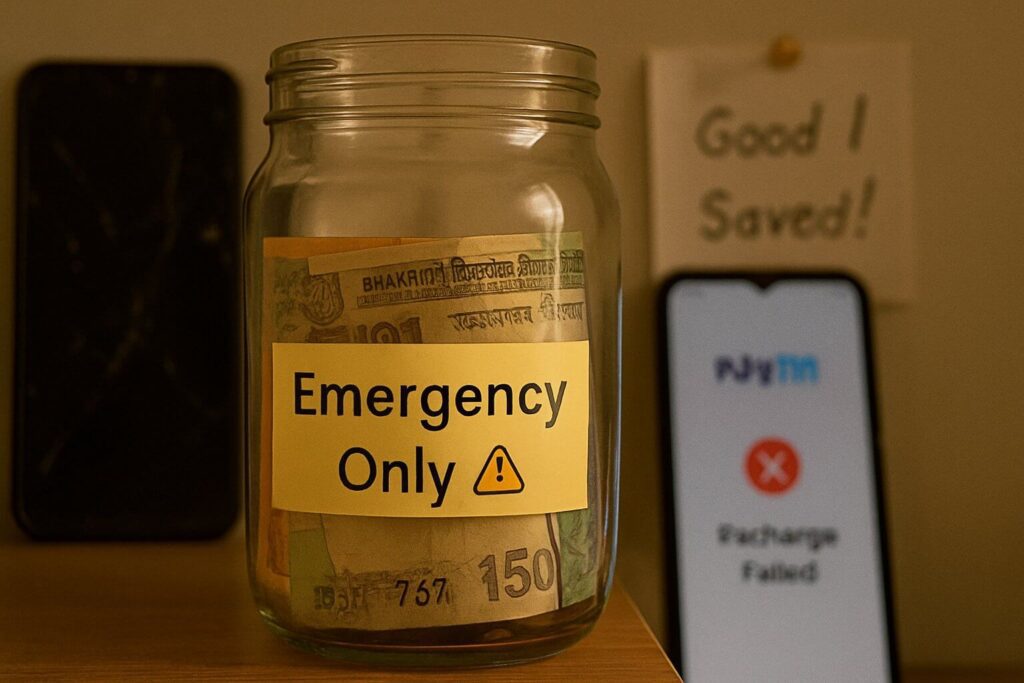

7. Ghar Pe Ek Emergency Jar Rakho 🏺

Ek jar lo, uspe likho “Emergency Only”, aur jab jab ₹10, ₹20, ₹50 bache, daal do.

Boring lag raha hai? Par jab mahine ke end mein Paytm balance ₹0 ho, tab yahi jar saviour banega! 💡

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

📲 Step 3: Free Resources Ka Smart Use Karo

Paisa kam hai? Koi baat nahi. India mein bahut kuch free bhi milta hai — bas dhoondhna aana chahiye.

- Free Wi-Fi: cafes, libraries, railway stations

- Free learning: YouTube, Google Digital Garage

- Govt. clinics/NGOs: free health checkups

- Parks: gym membership ki jagah jogging ya yoga kar lo

✨ Bonus tip: Google karo “free events near me” — poetry nights, free meals, workshops… sab milta hai!

🧃 Step 4: ₹20 Per Day Saving Habit Banao

Saving mandatory hai — income chhoti ho ya badi.

Start karo ₹20/day = ₹600/month. Itna toh easily ho jayega:

- Ek din ki chai skip karo

- Meesho se ek random item na kharido

- Bisleri ke bajaye ghar ka paani carry karo

📦 Yeh paisa PiggyBank app, Post Office RD, ya SIP mein daal do. Itna hi farq laata hai.

🛠️ Step 5: ₹500–₹1000 Side Income Ka Jugaad Lagao

Agar thoda time bacha hai, toh kuch extra paisa kama lo:

- Content writing (Internshala, Fiverr)

- Basic typing ya data entry

- Online tuition (Zoom pe)

- Instagram reels editing for small businesses

Even ₹500/month ka extra income = pura phone recharge free ho gaya! 😂

💬 Final Thoughts: Broke Nahi, Budget Pro Bano 💪

₹10,000 salary mein zindagi easy nahi, but possible hai. Aur jab tum budgeting habits build karte ho, woh tumhare saath life-long rehti hai.

Yeh sab [low income budgeting tips] apply karo, aur dekhna paisa manage karna kitna satisfying lagta hai. Broke feel karna bandh karo, smart feel karna start karo!

🎯 Itna yaad rakho: Salary kitni hai, yeh matter nahi karta. Uska management kaise karte ho — yahi game changer hai!

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪