Decentralized Finance (DeFi) Explained – Bank Ke Bina Passive Income Kaise Banaye 💰

Kabhi bank ke bahar lambi line mein khade hoke sirf passbook update karwayi hai? Ya phir “server down” ka pop-up dekha jab urgent payment bhejna tha? Tab lagta hai na — Yaar, paise bhejna WhatsApp message bhejne jaisa easy kyun nahi hai?

Well, welcome to the world of Decentralized Finance (DeFi) — ek aisa naya tareeka jisme tum save, invest, aur passive income earn kar sakte ho — bank, branch ya babu ke bina.

Aaj ke blog mein main tumhe Decentralized Finance in India ko simple language mein samjhaunga, batunga kaise kaam karta hai, aur kaise tum isse legit passive income kama sakte ho — chahe tumne kabhi crypto ka naam hi kyun na suna ho.

What is Decentralized Finance (DeFi)?

Simple shabdon mein, DeFi matlab tumhare saare banking kaam — jaise loan lena, paisa dena, invest karna, interest kamaana — bina bank ke.

Ye hota hai blockchain technology aur smart contracts ke through.

- No middleman: Tumhara paisa seedha doosre bande tak blockchain se jaata hai.

- 24/7 access: No “Bank Sunday ko closed” type drama.

- Global reach: Kisi bhi desh mein paise bhejo, invest karo, seconds mein ho jaata hai.

Example:

Maan lo tumhare paas ₹10,000 savings account mein pada hai. Bank tumhe 3% annual interest dega — matlab ₹25/month ke aas-paas.

DeFi mein tum ye ₹10,000 worth crypto kisi lending platform pe lend karke 5–10% annual interest kama sakte ho — kabhi daily, kabhi weekly payout milta hai.

India Mein DeFi Itna Popular Kyun Ho Raha Hai?

India already UPI ka king hai — speed, convenience, aur cashback sabko pasand hai. Lekin UPI bhi traditional bank system pe hi depend karta hai.

DeFi ek step aage hai:

- No bank account needed — bas internet + crypto wallet.

- Better returns — Bank ke 3–4% se zyada interest milta hai.

- Global access — Tokens, stablecoins, aur blockchain projects mein invest kar sakte ho.

2023 mein Chainalysis ke report ne India ko #1 crypto adoption rank diya, jisme DeFi ka bada role tha.

DeFi Ka Easy Analogy ☕

Socho tum ek roadside chai stall pe gaye.

- Bank system: Tum ek fancy café (bank) jaate ho, waiter ko order dete ho (loan/investment), woh serve karta hai — time lagta hai.

- DeFi system: Tum self-service chai counter (blockchain) pe jaate ho, khud chai lete ho, seedha payment karte ho — no waiter, no tip, no delay.

Ye possible hai smart contracts ki wajah se — jo automatic code hote hain blockchain pe. Condition match hote hi transaction execute ho jaata hai — koi human approval nahi chahiye.

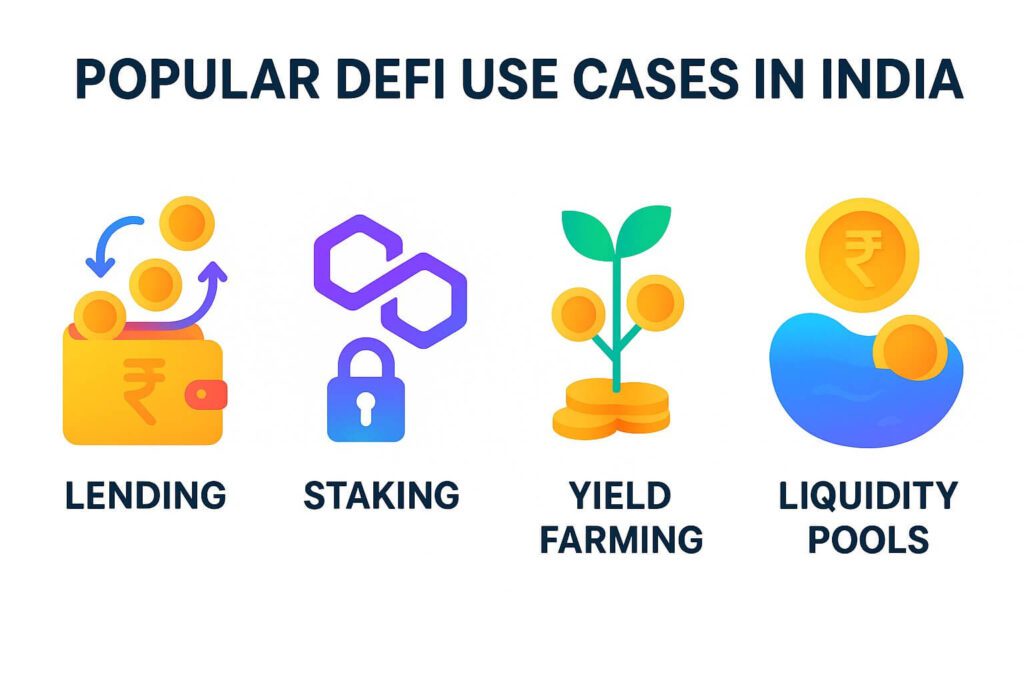

Popular Use Cases – DeFi Mein Kya Kya Kar Sakte Ho?

1. Lending Your Crypto

Bilkul bank ki tarah, tum apna crypto kisi aur ko lend karte ho via Aave ya Compound.

Return bank se kaafi zyada hota hai.

2. Staking

Agar tumhare paas kuch specific crypto coins hain, tum unhe “stake” karke rewards kama sakte ho.

Example: Polygon (MATIC) stake karne se 5–12% annual return mil sakta hai.

3. Yield Farming

Best return ke liye apna crypto alag-alag platforms pe shift karna — jaise banks ke FD rates compare karke switch karte ho.

4. Liquidity Provision

Apna crypto trading pool me daalo (Uniswap pe) aur trading fees ka ek hissa kamao.

DeFi Start Karne Ka Step-by-Step Guide (India Friendly)

Step 1: Basics Samjho

Crypto aur blockchain ke risks aur working samajhna zaruri hai. YouTube pe Coin Bureau ya Indian creators jaise Tanmay Bhat crypto series helpful hai.

Step 2: Crypto Wallet Banao

DeFi ke liye tumhe non-custodial wallet chahiye (keys tumhare paas hoti hain).

Popular options:

- MetaMask

- Trust Wallet

⚠️ Important: Wallet ka seed phrase offline likh ke safe jagah rakho. Lost = paisa gaya.

Step 3: Crypto Kharido

Indian exchanges se buy karo:

- CoinDCX

- WazirX

- ZebPay

Ethereum (ETH) ya Polygon (MATIC) jaise coins start ke liye best hote hain.

Step 4: DeFi Platform Connect Karo

Wallet ko connect karo:

- Aave (lending/borrowing)

- Uniswap (trading/liquidity)

- Curve (stablecoin trading)

Step 5: Small Start

₹1000 se bhi shuru kar sakte ho — pehle process samjho.

Passive Income Ke Main Tareeke 💵

1. Lending

- Platforms: Aave, Compound

- Risk: Medium

- Returns: 3–10% annually

- Example: 500 USDT lend karo, interest USDT me milega.

2. Staking

- Platforms: Lido, Binance Earn

- Risk: Low–Medium

- Returns: 4–15%

- Example: MATIC stake karo, reward MATIC me.

3. Liquidity Pools

- Platforms: Uniswap, SushiSwap

- Risk: Medium–High

- Returns: Fees + token rewards

- Example: ETH + USDT pool me daal ke fees earn karna.

4. Yield Farming

- Platforms: Yearn Finance, PancakeSwap

- Risk: High

- Returns: 10–100%+

- Example: Funds highest APY wale pool me shift karna.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Risks Ko Ignore Mat Karo 🚨

- Smart Contract Bugs: Code flaw se paisa chori ho sakta hai.

- Rug Pulls: Fake projects jo paisa leke bhaag jaate hain.

- Price Volatility: Crypto value gir sakti hai.

- Regulation Changes: India me government ke rules impact kar sakte hain.

💡 Rule: Sirf wahi invest karo jo lose hone pe tumhe problem na ho.

Meri Pehli DeFi Earning (True Story)

Pichle saal maine ₹5,000 worth USDT Aave pe invest kiya test ke liye.

- 1 month me ~₹40 interest mila.

Bank FD se zyada return, wo bhi without locking funds for years.

Process try karke hi samajh aata hai ki wallet connection, fees, interface kaise kaam karte hain.

DeFi vs Indian Banks – Quick Comparison

Feature | Bank Savings A/c | DeFi Lending |

Annual Interest | 2.5–4% | 4–10%+ |

Minimum Deposit | ₹500–₹10,000 | ₹1000 worth crypto |

Accessibility | 10am–4pm, Mon–Sat | 24/7 Global |

Middleman | Bank staff | None |

Risk | Low | Medium–High |

Tax Scene in India 📜

- DeFi se earning = crypto income.

- Tax: 30% + 4% cess.

- Loss offset allowed nahi.

Transactions ka record rakho — tools like KoinX, CoinTracker ka use karo.

Future of Decentralized Finance in India

Agar India ka youth aise hi crypto adopt karta raha, toh DeFi kaafi mainstream ho sakta hai.

Possible future:

- Indian startups ka apna DeFi platform.

- UPI + DeFi integration.

- Financial influencers ke through mass awareness.

Conclusion – Kya DeFi Tumhare Liye Hai?

Decentralized Finance in India ek financial revolution hai. Tum apne paise pe full control, better returns, aur global investment access pa sakte ho — wo bhi bank ke bina.

Lekin high returns ke saath high risk bhi hota hai. Chhota start karo, seekho, aur pehli earning ko profit nahi — learning samjho.

Agar tum bank ke 3% se zyada passive income chahte ho, toh DeFi ek interesting option ho sakta hai.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪