Digital Nomad Finance: Smart Money Management While Working Anywhere 🌏💰

Socho yaar – ek din tum Goa ke ek cozy café me baith ke laptop kholte ho, filter coffee sip karte ho, client ka kaam khatam karte ho aur shaam ko beach pe sunset walk enjoy karte ho. Agle hafte tum Manali ke ek homestay se kaam kar rahe ho, jahan background me snow-capped mountains hain.

Mast lag raha hai na? Yehi toh dream life hai – Digital Nomad Lifestyle. Matlab no 9–5 office, no boss pressure, sirf freedom to work from anywhere aur saath me travel.

Lekin sach yeh hai ki ye lifestyle Instagram photos jitna glamorous dikhai deta hai, utna simple nahi hota. Agar tumne apna paisa smartly manage nahi kiya, toh tumhari “work from anywhere” life ban jaayegi “broke everywhere.” 😅

Yahin entry hoti hai Digital Nomad Finance ki – ek smart system jahan tum apni income, expenses, savings aur investments ko handle karte ho while living a location-independent life.

Chalo, iss blog me step by step samajhte hain ki India ke 18–35 age group ke youngsters kaise smart money management karke ek safe aur sustainable digital nomad lifestyle enjoy kar sakte hain.

What is Digital Nomad Finance?

Simple shabdon me – Digital Nomad Finance ka matlab hai apna paisa manage karna jab tum ek jagah fixed nahi rehte.

Isme ye sab aata hai:

- 💻 Earning online – freelancing, remote jobs, startups, content creation.

- 🧳 Expenses control – har city/country me different cost of living hoti hai.

- 🧾 Tax planning – chahe tum Himachal me kaam karo ya Bali me, tax system samajhna zaroori hai.

- 💰 Investing & saving – taaki lifestyle ke saath-saath future bhi secure rahe.

In short, Digital Nomad Finance = travel + work + paisa ka balance.

Why Indians are Loving the Digital Nomad Life

Sach bolo toh, pandemic ne hum sabki soch badal di. Jab ghar se kaam possible ho gaya, toh logon ne socha – “Arre, agar ghar se kar sakte hain toh Goa, Rishikesh ya Bali se kyun nahi?”

Aur ab India me youth ke beech yeh lifestyle kaafi popular ho raha hai. Reasons:

- 🚀 Flexibility – No fixed office, no boss glaring at your screen.

- 🌍 Travel goals – Work + explore ek sath.

- 💵 Dollar income, rupee expense – Freelancers on Upwork/Fiverr earn $ and spend ₹. Solid profit.

- 🏡 Cost arbitrage – Jaipur ya Kochi jaisi affordable cities me stay, aur clients abroad se.

- 📱 Social media influence – Instagram & YouTube pe log dikhate hain “beach office” lifestyle, aur hum sabko lagta hai – “Mujhe bhi try karna hai!”

Lekin ek problem hai – unstable income + travel + expenses ka matlab hai financial mess, agar tumne proper planning nahi ki.

Step 1: Financial Base Strong Karo Pehle

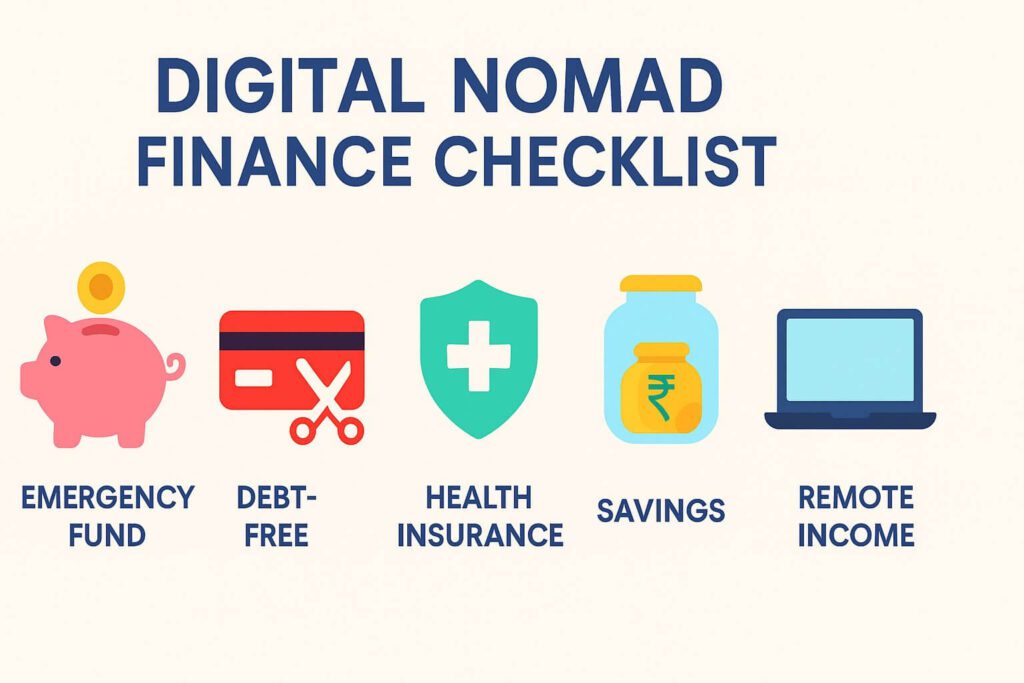

Bags pack karne se pehle ek baar reality check lo – Am I financially ready?

Yeh raha Digital Nomad Finance checklist:

- ✅ Emergency fund: At least 6 months ke expenses side me rakho (FD, liquid fund ya savings account).

- ✅ No credit card/personal loan debt: High interest wale debt ko settle karo.

- ✅ Stable income stream: Freelance clients, remote job ya apna online business.

- ✅ Insurance: Health + travel insurance compulsory hai.

- ✅ Savings cushion: Kam se kam ₹1–2 lakh “bad months” ke liye reserve.

👉 Example: Agar tum freelancing se ₹80,000/month kama rahe ho, toh nomad banne se pehle kam se kam ₹4–5 lakh side me rakho. Ye tumhe backup dega jab clients kam ho jayein.

Step 2: Budgeting Like a Smart Nomad

Nomad lifestyle = fun + expenses. Agar tumne budget control nahi kiya toh paisa hawa ho jaayega.

50/30/20 Rule (Nomad Edition)

- 🏠 50% Needs: Stay, food, travel between cities.

- 🎉 30% Wants: Parties, sightseeing, fancy cafés.

- 💰 20% Savings/Investments: SIPs, mutual funds, PPF, NPS.

👉 Living cost examples:

- Goa: ₹25k/month (shared hostel + scooty + food).

- Rishikesh: ₹18k/month (cheap stays + thali khana).

- Bali: ₹50–60k/month (villa + scooter + café culture).

So, pehle research karo cost of living. Har jagah ka budget alag hota hai.

Step 3: Banking & International Transactions

Nomad banne ke baad sabse bada headache hota hai paisa receive karna.

- Indian clients ke liye: UPI, NEFT, IMPS. Easy.

- Foreign clients ke liye: Wise (TransferWise), Payoneer, ya direct SWIFT transfer.

💡 Pro Tips:

- PayPal avoid karo (fees bohot high hai). Wise best hai USD/EUR receive karne ke liye.

- Agar tum long-term abroad ho, toh NRE/NRO account khol lo. RBI guidelines check karo account opening ke liye.

- Always rakho 2–3 backup debit/credit cards (Paytm HDFC forex card bhi acha option hai).

👉 Example: Ek dost Upwork se $2000/month earn karta tha. PayPal use karke ₹10k fee chala jaata. Wise shift karke usne woh paisa save kar liya.

Step 4: Taxes for Digital Nomads (India Walo ke Liye)

Sabse confusing part – taxes. Sawal hota hai: “Agar main India ke bahar hoon toh tax bharna padega?”

- Agar tum 182 din se kam India ke bahar ho, toh tum resident count hote ho. Matlab Indian tax on global income.

- Agar 182 din se zyada bahar ho, toh NRI count hote ho. Tab sirf Indian income taxable hoti hai.

- Goa, Himachal me reh kar USD income kama rahe ho? → Still taxable in India.

👉 Pro Tip: Ek achha CA hire karo jo digital nomad taxation samajhta ho. Penalty lene se acha hai CA ko ₹5–10k de do.

Step 5: Investments for Nomads

Bahut log sochte hain: “Travel karte time investment kaise karein? Baad me kar lenge.” Big mistake.

Early investment = early financial freedom.

Best Investment Options for Nomads:

- SIPs in mutual funds (Groww, Zerodha, ET Money apps).

- Index funds/ETFs – low cost, long-term compounding.

- NPS – retirement ke liye.

- SGBs or Gold ETFs – portable, safe.

- Liquid funds/FDs – short-term needs ke liye.

👉 Example: ₹10,000/month SIP in Nifty Index Fund = 20 saal me ₹1+ crore. Travel bhi karo, retirement bhi safe.

“Aapko yeh concept pasand aa raha hai toh aapko yeh wala blog bhi kaafi useful lagega

Step 6: Cost Cutting Without Sacrifice

Nomad life me smart spend karna zaroori hai. Cheap nahi, smart.

- 🏡 Co-living spaces: Zostel Workation, NomadGao (₹10–15k/month).

- 🍳 Cook simple meals: Roz Swiggy karega toh khud bankrupt ho jaayega.

- 🛫 Off-season travel: Flights + hotels 30% saste milte hain.

- 📱 Local SIM cards: Jio/BSNL roaming avoid karo, har city me local sim cheap padti hai.

- 💻 Coworking spaces: Cafés ke Wi-Fi pe trust mat karo.

👉 Example: Bangalore me ₹40k/month kharch ho raha tha. Same nomad Himachal gaya, ₹25k/month me mast life chal rahi hai.

Step 7: Multiple Income Streams Banao

Nomad life = income kabhi high, kabhi low. Solution? Multiple income sources.

- Freelancing (design, writing, coding, marketing).

- Remote jobs (startups hire remote Indians).

- YouTube / Insta reels.

- Affiliate marketing / Blogging.

- Online courses, eBooks.

- Coaching/consulting.

👉 Example: Ek digital marketer ₹60k freelancing + ₹15k blog + ₹20k course sale = ₹95k/month earn karta hai. Ek source slow ho gaya toh bhi paisa aata hai.

Step 8: Mindset Shift – Tourist vs Smart Nomad

Sabse bada mistake: Nomad life ko vacation samajhna.

- ❌ Tourist mindset: Luxury hotels, shopping, fine dining roz-roz.

- ✅ Smart Nomad mindset: Balance between work, fun, aur savings.

👉 Example: Goa me ₹3000/night resort vs ₹15k/month co-living. Same vibe, half price.

Nomad = freedom, not daily luxury.

Step 9: Tools & Apps Every Nomad Must Use

Digital toolkit ready rakho:

- Finance: Groww, Zerodha, ET Money, Wise, Payoneer.

- Budgeting: Walnut, Moneyfy.

- Remote work: Notion, Slack, Zoom.

- Co-living stays: Zostel Workations, NomadGao, Outsite.

- Travel: Skyscanner, IRCTC, RedBus, MakeMyTrip.

Step 10: Common Mistakes Nomads Karte Hain

- High income months me save nahi karna.

- Taxes ignore karna.

- Har jagah Zomato/Swiggy + Uber.

- Insurance skip karna.

- Single income source pe depend karna.

👉 Golden Rule: Earn in dollars, spend in rupees, save in assets.

Final Thoughts: Digital Nomad Finance = Freedom Without Stress

Digital nomad banna sirf “beach office” dikhane ka game nahi hai. Ye lifestyle tabhi successful hai jab tumhara paisa control me ho.

Agar tum Digital Nomad Finance master kar loge, toh:

- Aaj ke liye paisa hoga (fun & travel).

- Kal ke liye safety hoga (emergencies).

- Future ke liye investments hoga (retirement, freedom).

So, chahe tum Goa café se kaam kar rahe ho ya Bali ke coworking villa se – hamesha yaad rakho:

👉 Work smart.

👉 Spend wisely.

👉 Invest regularly.

Yahi hai asli secret of Digital Nomad Finance.

📢 Iss blog ko apne doston ke saath share karo .

Together grow karte hain! 💪